AI Reshaping Global Industry Landscape, From Technological Breakthrough to Commercial Value

AI (Artificial Intelligence) has become the central arena for global technological competition, with its rapid development and extensive penetration exceeding all expectations. AI is swiftly reconstructing value chains across industries. In fields such as intelligent search, autonomous driving, industrial robotics, and creative design, AI has demonstrated disruptive potential; in vertical industries like finance, healthcare, and education, its value is even more evident. For instance, intelligent algorithms optimize financial trading decisions, AI-assisted diagnostics significantly enhance medical accuracy, and personalized learning platforms transform educational experiences.

AI’s significance in banking has evolved beyond mere process automation to emerge as a pivotal force driving business growth. Driven by digital transformation and increasing industry competition, the banking industry urgently needs to embed AI within its strategic core and undertake comprehensive business reinvention through technological innovation. Practical experience demonstrates AI’s dual strategic value: on one hand, it serves as an essential tool for improving quality and efficiency; on the other hand, it is a primary catalyst for fostering new business models, reshaping banking’s developmental approach and competitive landscape.

AI Evolving from Efficiency Tool to Business Development Engine

Reshaping Banking Business Logic

AI applications have advanced beyond traditional process automation, such as robotic process automation (RPA) for repetitive tasks, and are evolving towards end-to-end intelligence. For instance, in credit operations, intelligent risk-control systems expedite approval processes and significantly reduce non-performing loan ratios. In marketing, precision models integrate real-time market data with customer preferences to offer customized products and personalized investment advice. Within internal operations, automated processes deliver substantial gains in efficiency through intelligent workflows and optimized resource allocation. Consequently, the banking business model is shifting from a "human decision-making assisted by tools" paradigm to one characterized by "AI-driven processes with manual oversight." Competitive advantages are moving away from traditional capital scale towards data assets and algorithmic models, making these emerging capabilities the focal points of future industry competition.

Value Unlocking from Data Assets

Through systematic data governance, banks transform their extensive accumulated structured and unstructured data-such as customer profiles and transaction records-into iterative "data capital. " For example, dynamic pricing mechanisms, guided by user credit behavior and AI models, enable real-time loan interest rate adjustments, optimizing the risk-return balance. Scenario-driven marketing powered by AI predictive models accurately anticipates customer needs (such as home purchases or educational expenses), proactively offering tailored products. Enhanced data capabilities enable banks to transcend their traditional roles as mere capital intermediaries and evolve into robust data service providers. Banks can thus offer open data interfaces to third-party entities, providing advanced financial services including risk assessments derived from data insights.

Service Model Innovation and Ecosystem Reconstruction

Driven by AI technology, banks are introducing innovative service models and undergoing comprehensive ecosystem transformation:

AI technology enables the creation of next-generation, interface-free financial services. Optical character recognition (OCR) facilitates intelligent data capture and processing of documents, while multimodal biometric authentication, including facial recognition, ensures secure, efficient remote account opening. Moreover, innovative user interactions, such as voice assistants and smart advisors, significantly extend service access to youth, elderly populations, and customers in emerging markets, greatly enhancing the digital service experience beyond traditional mobile app functionalities.

Open Banking embeds financial services deeply into diverse scenarios such as social networks, e-commerce, travel, governmental processes, and supply chains via standardized API interfaces. AI technologies enhance Open Banking by boosting service accuracy through intelligent API optimizations and personalized recommendations. Additionally, AI strengthens security and risk management using biometric verification and anti-fraud measures. It also advances Open Banking from passive responses towards proactive, intelligent recommendations. Meanwhile, Open Banking supplies valuable financial data for AI model training. This tight integration accelerates ecosystem cooperation, promotes inclusive financial services for individuals and SMEs, expands financial service boundaries, and fosters innovation centered around banks.

Intelligent Organizational Evolution

Transformation of technology team roles

Technology departments evolve from supporting roles to strategic drivers. Traditionally focused on IT operations and maintenance, technology teams must transition into innovation hubs dedicated to developing advanced AI risk management systems and intelligent advisory platforms, closely collaborating with business units.

Enterprise-wide AI literacy

"AI thinking" emerges as a critical competency for all employees, not only technical specialists. Business personnel must also master AI tools to enhance operational productivity. Consequently, banks need comprehensive AI training frameworks and performance evaluation systems covering all employees.

Summary

AI is propelling banks from traditional financial institutions into intelligent digital hubs. This evolution blurs the distinction between banks and technology companies, embeds financial services into everyday scenarios, and shifts competitive dynamics toward collaborative ecosystems, ultimately redefining the future landscape of the banking industry.

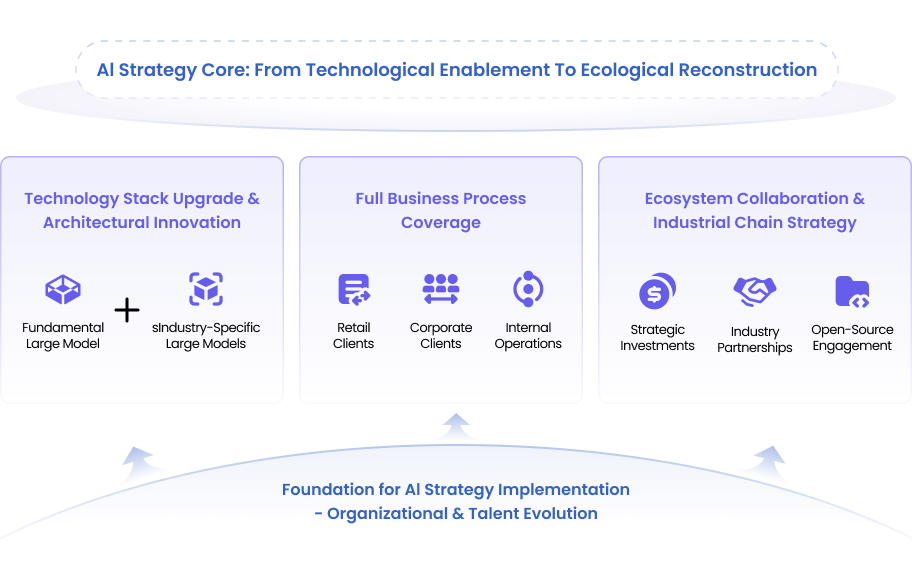

AI Core Strategy and Implementation Foundation

Banking AI Core Strategy

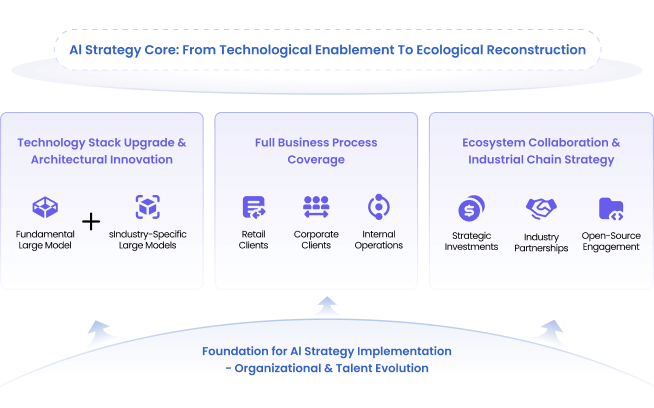

In the rapidly evolving landscape of AI technology, banking AI strategies should concentrate on the following three key dimensions:

• Intelligent technology architecture

Develop a hybrid technology platform combining large-scale models with specialized smaller models. This ensures a balanced integration of generalized capabilities and vertical domain-specific accuracy.

• Comprehensive business process transformation

Expand AI applications from isolated pilot projects to full-cycle integration throughout the entire business chain, enabling consistent and cohesive operations.

• Collaborative open ecosystem

Establish an AI ecosystem through strategic investments, industrial partnerships, and active participation in open-source communities. This involves providing targeted financial support to the AI industry chain, jointly developing industry-specific Platform-as-a-Service (PaaS) solutions with cloud providers, and disseminating standardized AI components to democratize technology.

Implementation Foundation

AI infrastructure development

Create a structured AI technology platform by deploying advanced supercomputers to enhance computational power, optimizing AI training efficiency. Further enhance capabilities for data collection, integration, and employ advanced privacy-preserving technologies.

Organizational capability transformation

Set up dedicated AI technology and business innovation units, attract talent with specialized AI expertise, and foster deeper integration between employees and AI tools through targeted training programs and organizational culture transformation.

Lightweight AI Solutions for Banking

Adopting lightweight AI solutions that emphasize targeted scenarios and innovative ecological partnerships provides distinct advantages in terms of rapid deployment, cost-efficiency, and ecosystem synergy. This strategic approach helps banks avoid direct competition with industry giants, creating differentiated strengths within niche markets.

• Agile technology deployment

Utilize cloud-based services for scalable, demand-driven computing power. Leverage optimized high-performance open-source AI models for localized deployment, reducing costs while maintaining robust AI capabilities.

• Scenario specialization

Focus on specific industries and customer segments by employing AI to craft bespoke financial products and personalized service solutions. Intelligently analyzing customer needs and behaviors enhances customer loyalty and engagement.

• Ecosystem resource partnerships

Collaborate strategically with technology firms and actively engage in industry alliances to jointly develop AI application scenarios. Shared resources and expertise accelerate capability development and minimize research and development risks and costs.

Summary

By adopting lightweight AI strategies, banks can avoid commoditized competition and establish unique competitive advantages within specialized market segments. This transition allows traditional financial institutions to evolve into sophisticated, intelligent financial service platforms.

MuRong's Practices in the AI Field

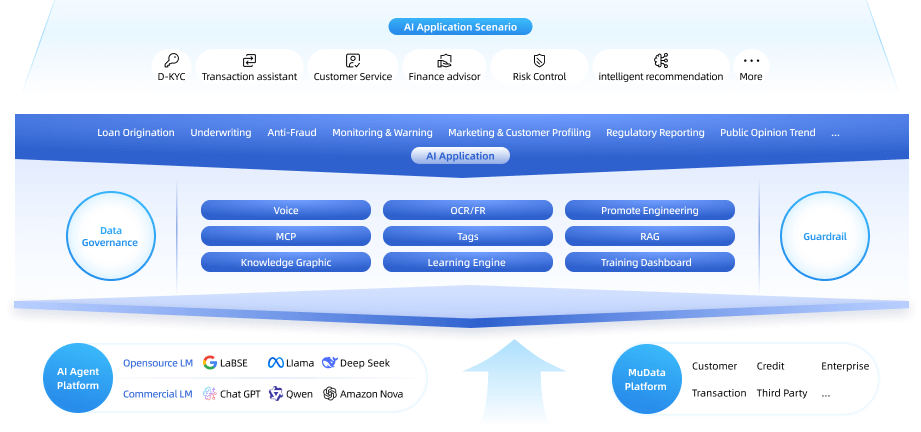

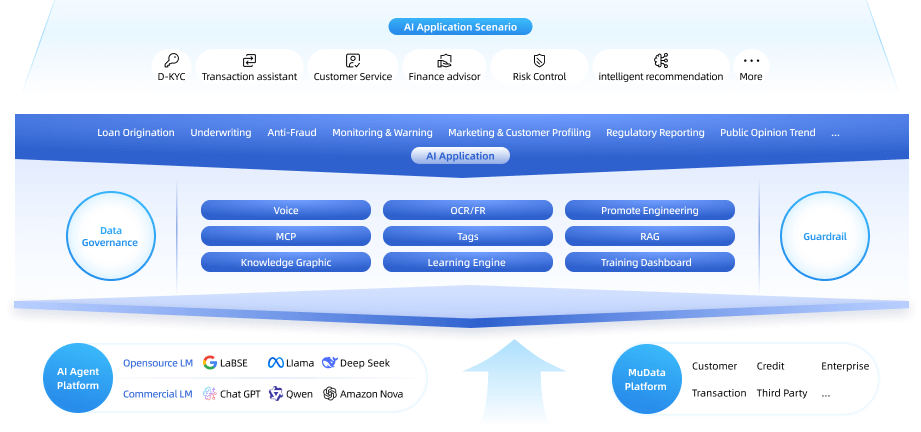

MuRong Technology’s intelligent AI platform, MuAI, is integrated into two flagship digital banking products: MuRong IDO and MuRong DBS. Guided by the principles of "scenario-driven, secure and controllable, and efficient collaboration, " MuAI employs a layered architecture, providing ready-to-use AI applications including intelligent customer service, precision marketing, and intelligent risk control. Additionally, it offers customized solutions and technological upgrades tailored to specific banking scenarios, ensuring continuous AI innovation capabilities.

Multi-Layer, Loosely Coupled Technology Architecture

• Base Layer (Large Model)

Integrates open-source and commercial large model capabilities, dynamically matching business requirements through routing mechanisms. This approach optimizes application quality, efficiency, and operational costs.

• Middle Layer (Agents & Governance)

Integrates leading mainstream AI technology frameworks. Agents deliver flexible application adaptability, Retrieval-Augmented Generation (RAG) boosts accuracy and efficiency in specialized domains, fine-tuning and training enhance vertical-specific AI capabilities, multi-cloud platforms (MCP) increase overall application flexibility, and protective technologies safeguard against AI data contamination.

• Application Layer (Application Modules)

Modular components tailored for specific scenarios support four critical domains—user experience, risk management, decision-making, and operations. Regular component and interface upgrades ensure rapid adaptability to changing business demands, directly linking technological outputs to tangible business outcomes.

AI Application Scenarios

OCR Recognition Processing

Rapid and precise text extraction significantly boosts accuracy and data entry efficiency.

Biometric Security Authentication

Employs facial and multimodal biometric technologies to establish secure remote account-opening processes.

AI Transaction Assistant

Facilitates intuitive payments via voice and facial recognition.

Intelligent Customer Service

Provides 24/7 customer service, effectively identifying customer intent and forecasting service demands.

Precision Marketing Assistant

Analyzes customer profiles, automates product matching, and generates personalized marketing strategies.

Personalized Recommendation Service

Delivers targeted product suggestions and real-time responses by analyzing customer behavior and preferences.

Online Shopping Assistant

Enhances shopping experiences through intelligent product filtering and price-comparison analytics.

Intelligent Credit Decision-Making

Combines comprehensive credit scoring, customized loan solutions, and post-loan behavior monitoring to strengthen risk control.

Wealth Management Consultant

Offers financial advisory services including bill notifications, repayment alerts, financial health checks, asset allocation recommendations, and personalized financial planning.

Core Features: Balancing Flexibility, Efficiency, and Compliance

• Flexible expansion

Rapidly incorporates emerging AI technologies, ensuring continuous system evolution and avoiding technological lock-in.

• Lightweight Efficiency

Optimized solutions tailored for banks of varying scales to ensure optimal resource utilization.

• Strict Compliance

Embedded control mechanisms ensure AI applications adhere rigorously to financial regulations, effectively managing business risks.

AI-Enabled Banking Transformation: Intelligent Practices at NCBA and KCB

Leading international banks, NCBA and KCB, have successfully implemented MuRong Technology’s MuRong DBS and MuRong IDO platforms, respectively, deeply integrating AI to achieve strategic business upgrades. NCBA leverages intelligent push notifications and AI-driven assistants for precise customer engagement, while KCB enhances operational efficiency and user convenience through intelligent operations and automated payment processes.

Future Outlook

AI is ushering banks into a transformative era characterized by intelligent operations. MuRong Technology’s advanced AI solutions have empowered banks with substantial upgrades in intelligent customer service, real-time risk management, and precision marketing. Looking forward, MuRong Technology remains committed to tracking state-of-the-art AI advancements, further investing in large-model R&D within financial services, and continuously enhancing its robust AI platform. As a trusted partner, MuRong Technology aims to explore boundless AI-driven possibilities alongside banking clients, enabling financial institutions to remain agile and competitive in an increasingly dynamic marketplace.