Survival challenges in the digital age

With the rapid advance of mobile payments and digital banking,

the traditional self-service banking market is undergoing profound change.

In China,

a global leader in digital payment adoption,

demand for cash transactions has declined due to the widespread

use of online payment methods such as Alipay and WeChat Pay. As a result,

basic deposit and withdrawal activity at ATMs continues to fall.

At the same time,

the proliferation of digital wallets has accelerated the shift toward cardless transactions,

further reducing the use of traditional magnetic stripe card readers. According to the latest data,

the total number of ATMs in China fell from 1.097M in 2019 to 802,700 in 2024,

a decline of 30 percent,

reflecting the impact of mobile payments on the global self-service banking equipment market.

Many banks worldwide continue to rely on outdated self-service equipment systems.

These closed architectures suffer from technology stagnation and compatibility constraints

that hinder integration with modern payment ecosystems and create multiple operational difficulties.

High replacement costs and compatibility challenges

Outdated self-service equipment presents significant upgrade difficulties. Comprehensive replacement entails prohibitive costs, while gradual updates are constrained by legacy technology stacks. Hardware upgrades and software iterations require long cycles. Banks therefore need cost-effective approaches that ensure compatibility between older equipment and new systems, preserving service value and return on investment.

Rising operational complexity and cost

Lack of standardization across equipment and vendor protocols complicates centralized maintenance and monitoring. As equipment ages, monitoring and maintenance become more complex, driving up the cost of manual inspections and repairs. This escalating cost pressure is a major challenge to operational efficiency.

Transformation hurdles for open architecture

Although next-generation self-service equipment systems support rapid iteration, achieving seamless compatibility and deployment with legacy systems remains a critical hurdle during transformation.

Diversified ecosystem restructuring

Cash services remain indispensable in areas with low electronic-payment penetration, including remote mountainous and plateau regions and locations where mobile networks and smartphones are not widely adopted. They are also essential in elderly communities and in scenarios serving foreign visitors. At the same time, a new generation of self-service equipment systems is creating market opportunities through ecosystem partnerships and functional innovation. By integrating public-service features such as foreign currency exchange and utility bill payment, these systems have evolved into multifunctional integrated service terminals that unlock new avenues for growth. Their applications now extend beyond traditional financial boundaries into sectors such as healthcare, government services, and transportation, demonstrating broader development prospects.

Comparative view: traditional vs. integrated service terminals

Technology enablement in digital transformation

While the rapid development of digital banking has affected legacy self-service equipment, digital transformation has also created opportunities for technological empowerment and functional upgrades to self-service equipment systems. By integrating modern digital technologies, new-generation intelligent terminals are evolving from simple cash-handling machines into multifunctional financial service stations.

Cardless services:

Support cash withdrawal via QR code or mobile pre-order, enabling users to complete transactions without a physical bank card.

Intelligent interaction:

Incorporate AI voice assistants and visual interfaces to simplify operations and improve accessibility for elderly users and those with special needs.

Remote verification:

Utilize video teller machines (VTM) or facial recognition to enable remote identity authentication, expanding the scope of available services.

Innovative practices of MuRong SES

The banking industry’s self-service equipment is at a strategic inflection point. Mobile payments continue to compress traditional cash-centric services, yet digital enablement is opening new service models and market opportunities. Banks need to move beyond the narrow view of cash-only terminals and develop a new generation of intelligent service terminals through functional re-engineering, ecosystem integration, and technology upgrades, preserving essential cash services while expanding into broader digital service scenarios.

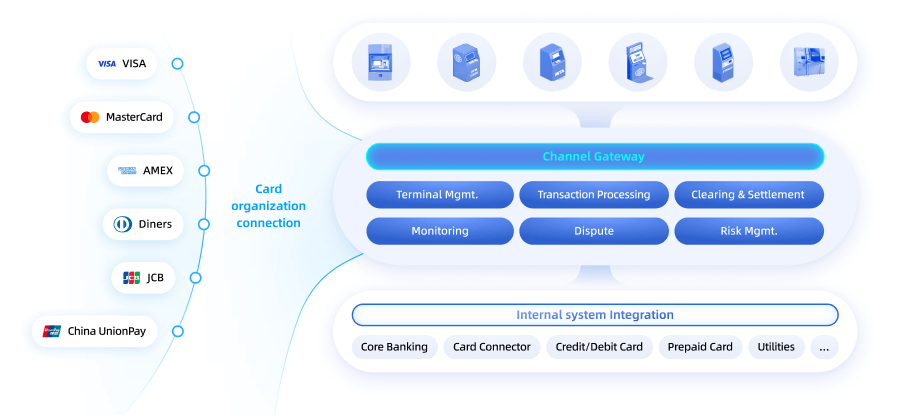

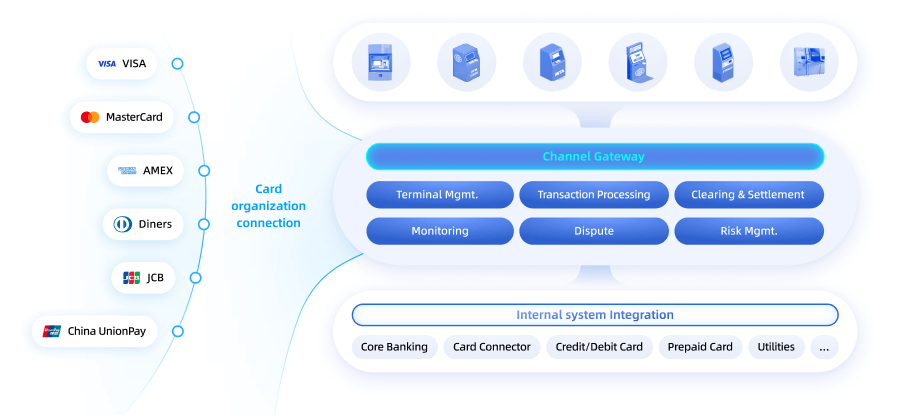

Based on a deep understanding of pain points and global development trends in self-service equipment systems, MuRong Technology has introduced MuRong SES (an open, multi-vendor self-service equipment system). The platform addresses core shortcomings of traditional equipment, including limited functionality and outdated technology. Through open architecture and intelligent enhancements, it helps banks reposition self-service terminals from transaction processors to ecosystem connectors, rebuilding competitiveness in the digital era.

MuRong SES

MuRong SES is built on a distributed microservices architecture that provides high scalability, openness, and agile delivery. It supports seamless integration with diverse self-service equipment, including ATMs, CDMs, and CRSs, helping banks overcome technical bottlenecks. The solution offers a comprehensive capability stack covering terminal management, transaction processing, risk-control management, dispute management, and channel gateways. It enables unified device management, remote maintenance, and real-time monitoring; efficiently handles complex services such as cross-border transactions, multi-currency exchange, and utility bill payments; and supports rapid integration with mainstream payment channels and new multi-vendor devices. Through modular design, MuRong SES addresses the diverse needs of the terminal estate, significantly enhancing service capability, optimizing customer experience, and improving operational efficiency.

MuRong SES: Core capabilities and Business value

• Modular architecture

• Pre-integrated protocols

• Seamless compatibility with legacy systems and equipment

• Fast deployment

• Delivers strong ROI for banks and financial institutions

• Seamless compatibility across multi-vendor, multi-type equipment

• Rapid integration of new devices

• Reduces integration costs for new devices

• Coverage of critical performance metrics

• Remote real-time alerts and fault diagnosis

• Unified remote maintenance for fault detection, analysis, auto-recovery, and automated upgrades

• Reduces labour requirements

• Innovative functions such as foreign currency exchange and utility bill payments

• Real-time alerts on transaction success rates and abnormal behaviors

• Protection against card skimming and fraud

• Reduces financial risk

• Cardless transactions

• Intelligent voice interaction and visual interfaces

• Enhances accessibility for elderly users and those with special needs

• Supports rapid development and deployment of new products

• Accelerates time to market for new services

• Supports customization and rapid iteration

MuRong Technology’s Global Practices

MuRong Technology maintains a highly experienced technical team with deep expertise in designing and delivering large-scale and ultra-large-scale financial systems. Leveraging the MuRong SES platform, the team has implemented numerous self-service equipment system projects for major commercial banks in China and overseas.

Successful practices in the China market

Bank of Communications

One of China’s five major commercial banks partnered with MuRong Technology to standardize management of more than 30,000 ATM terminals nationwide, establishing a highly efficient self-service equipment network. The system processes more than one million transactions daily, significantly expanding service coverage and improving operational efficiency.

China Construction Bank

One of China’s largest commercial banks completed the intelligent transformation of tens of thousands of ATM terminals with support from MuRong Technology’s implementation team, demonstrating strong technical capability and system reliability as an industry benchmark.

Shenzhen Development Bank

A leading innovative commercial bank partnered with MuRong Technology to upgrade thousands of ATM terminals and build an integrated service network covering key scenarios such as transportation hubs and government service centers, effectively enhancing the bank’s service capability within the smart city ecosystem.

Bank of Suzhou

A model regional commercial bank collaborated with MuRong Technology’s implementation team to transform and upgrade more than 1,000 ATM terminals. The program focused on services for small and medium-sized enterprises and community residents, underscoring the role of regional banks in supporting the real economy and local livelihoods.

Global expansion and overseas cases

Nigeria Inter-Bank Settlement System (NIBSS)

NIBSS, a leading financial infrastructure operator in West Africa, selected MuRong Technology as its technical partner after rigorous evaluation. MuRong’s implementation team modernized the national payment network within six months. The system integrates multiple types of self-service equipment and underpins a comprehensive financial services ecosystem covering commercial banks, telecom operators, education, e-commerce, and additional sectors.

MuRong Technology’s Global Practices

MuRong Technology maintains a highly experienced technical team with deep expertise in designing and delivering large-scale and ultra-large-scale financial systems. Leveraging the MuRong SES platform, the team has implemented numerous self-service equipment system projects for major commercial banks in China and overseas.

Successful practices in the China market

Bank of Communications

One of China’s five major commercial banks partnered with MuRong Technology to standardize management of more than 30,000 ATM terminals nationwide, establishing a highly efficient self-service equipment network. The system processes more than one million transactions daily, significantly expanding service coverage and improving operational efficiency.

China Construction Bank

One of China’s largest commercial banks completed the intelligent transformation of tens of thousands of ATM terminals with support from MuRong Technology’s implementation team, demonstrating strong technical capability and system reliability as an industry benchmark.

Shenzhen Development Bank

A leading innovative commercial bank partnered with MuRong Technology to upgrade thousands of ATM terminals and build an integrated service network covering key scenarios such as transportation hubs and government service centers, effectively enhancing the bank’s service capability within the smart city ecosystem.

Bank of Suzhou

A model regional commercial bank collaborated with MuRong Technology’s implementation team to transform and upgrade more than 1,000 ATM terminals. The program focused on services for small and medium-sized enterprises and community residents, underscoring the role of regional banks in supporting the real economy and local livelihoods.

Global expansion and overseas cases

Nigeria Inter-Bank Settlement System (NIBSS)

NIBSS, a leading financial infrastructure operator in West Africa, selected MuRong Technology as its technical partner after rigorous evaluation. MuRong’s implementation team modernized the national payment network within six months. The system integrates multiple types of self-service equipment and underpins a comprehensive financial services ecosystem covering commercial banks, telecom operators, education, e-commerce, and additional sectors.

Summary and future outlook

As digital transformation accelerates, banks’ self-service businesses are entering a new stage of development. Through technology innovation and ecosystem integration, MuRong SES provides a modern solution for self-service equipment systems. It significantly enhances operational efficiency and service capability and establishes a multi-scenario service model that integrates finance, daily life, and government services.

As the application of new technologies such as AI deepens, MuRong SES will continue to evolve. The platform will provide sustained momentum for banks’ digital transformation and support more advanced infrastructure for the development of inclusive finance.