The Rise and Global Development of Digital Banking

Digital Banking Reshapes the New Financial Ecosystem

The essence of digital banking is to reconstruct traditional banking business processes with financial technology at its core. Its main advantages include:

Convenience:

Users can complete financial operations anytime, anywhere through mobile phones or computers.

Innovation:

Provides personalized services and precision marketing through big data, AI and other technologies.

Low Cost:

Reduces physical branches and labor costs, lowering operating expenses.

Inclusiveness:

Reaches long-tail customers not covered by traditional banks, especially SMEs and individuals in developing countries, through low-cost services.

Globalization:

Breaks geographical restrictions to serve global customers.

Digital banking is not only suitable for commercial banks, but also attracts non-bank institutions such as financial technology companies, internet companies and telecom operators. These enterprises can quickly enter the financial services field and expand business boundaries through digital banking technology.

Global Development Status of Digital Banking

In recent years, digital banking has flourished globally, especially in emerging markets such as Asia, Africa and Latin America. In China, as a global leader in digital banking and mobile payments, China's digital banking market not only has a large scale,

but also leads the world in technological innovation and business models. In Africa, thanks to the popularity of smartphones and the improvement of financial inclusion,

mobile payments and digital credit business have grown rapidly in Africa, with 136 million new digital bank accounts added, accounting for more than 70% of the global new accounts.

MuRong Technology's Digital Banking Products Provide Technology Empowerment and Ecosystem Innovation

Options for Digital Transformation

In the process of digital transformation, banks need to choose appropriate implementation paths according to their own technical foundation, resource investment and organizational needs. Common solutions mainly include the following:

Fully Replace the Core:

Architecturally reconstruct the original core system to build a new generation of technical framework and system that meets the needs of digital banking business.

Journey-led Progressive Digitalization:

Make gradual improvements to existing systems, provide limited digital products and services through partial function optimization and module upgrades and achieve phased digital transformation goals.

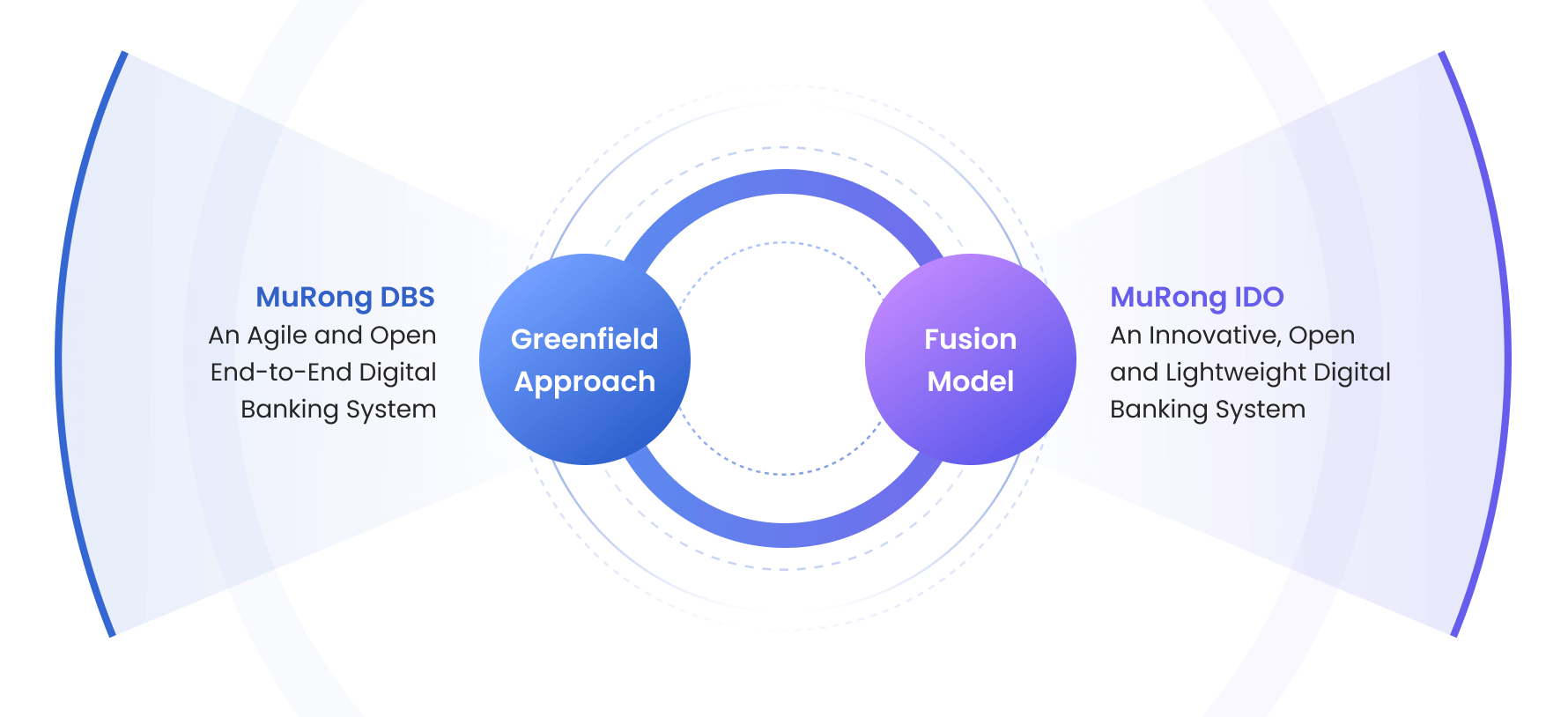

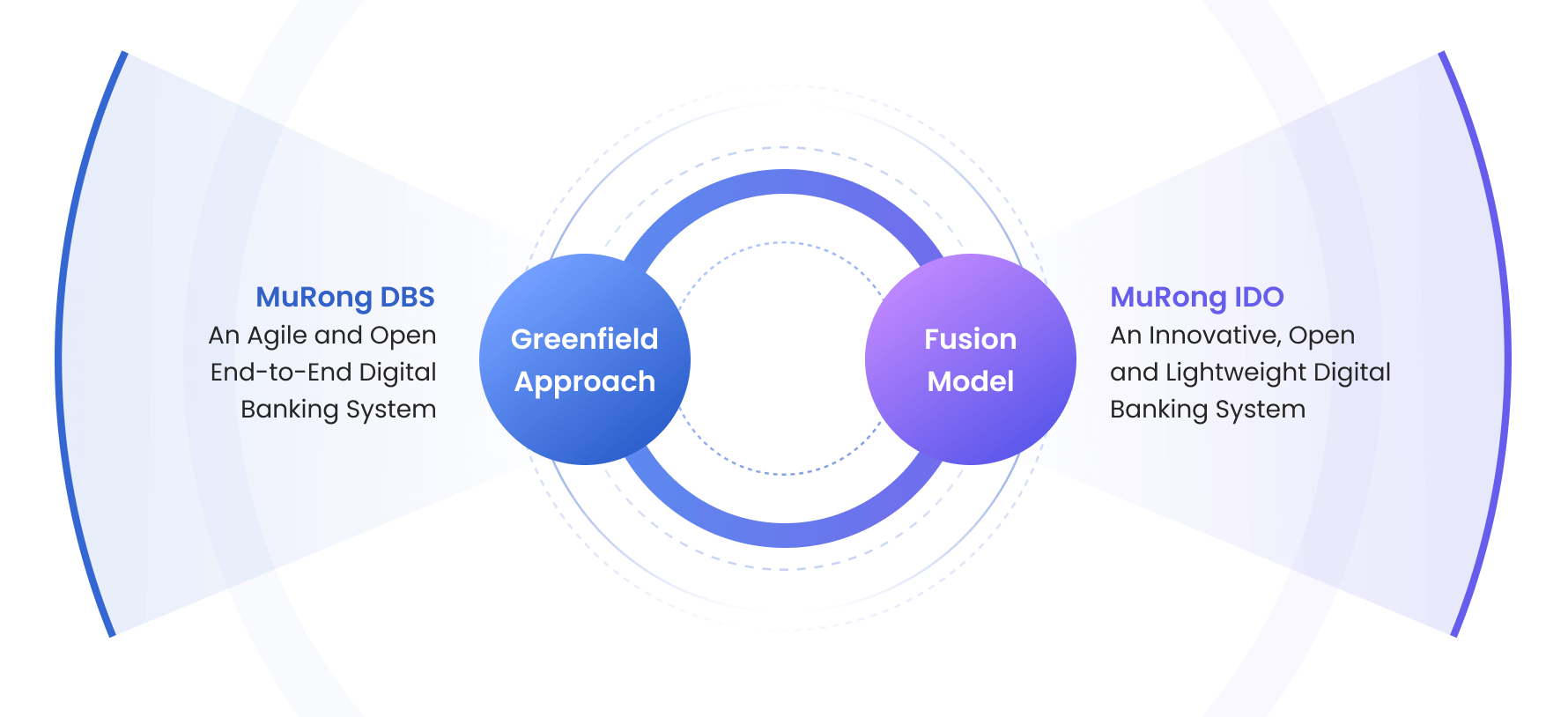

"Greenfield" Approach:

A digital construction methodology proposed by McKinsey, which advocates completely abandoning traditional legacy systems, designing and building a new digital business platform from scratch to achieve rapid innovation and digital transformation.

"Fusion" model:

MuRong Technology combines the advantages of the " journey-led progressive digitalization" and the "greenfield approach" to create a new hybrid digital transformation solution that provides both an independent digital banking system and seamless connection with existing core systems to achieve business integration.

MuRong Technology's Two Digital Banking Products

For different digital transformation Paths, MuRong Technology provides two digital banking products. MuRong DBS (Digital Banking System) and MuRong IDO (An innovative and open digital banking system).

MuRong Technology's products have advanced technical architecture, comprehensive functional suite and excellent commercial value.

Advanced Technical Architecture:

Adopts cloud-native and microservice architecture to achieve elastic expansion and ensure system security, agility and openness.

Integrates D-KYC and combines biometric technology to provide multiple verifications, balancing security compliance and user experience.

Diversified deployment options, supporting both SaaS cloud services and localized deployment modes.

Complete Functional System:

Integrates core banking functions such as mobile savings, mobile loans, mobile wallets and mobile payments.

Omni-Channel support, including Super App, mini-programs, USSD, online banking, etc.

Provides rich industry solutions and achieves seamless connection with partner systems through open APIs.

Excellent Commercial Value:

Modular product portfolio supports on-demand purchase and phased expansion, lowering the threshold for digital transformation.

Rapid deployment capability shortens product launch time through parameterized configuration to achieve rapid market entry.

Multi-tenant architecture: Realizes resource sharing and independent operation of branches in different regions to reduce costs.

Flexible implementation strategy: Provides two optional solutions: one-time complete delivery or phased implementation.

Improved return on investment: Supports open-source databases and middleware, connects ecosystems through open platforms and mini-programs, reduces investment while improving profitability.

Application Cases – From Zero to Scale

Digital Banking Implementation Case Studies:

1. NCBA (Kenya)

NCBA adopted MuRong DBS to complete digital transformation and expand Africa's digital banking business territory, becoming a benchmark for digital banking in Africa.

NCBA is Kenya's third largest bank and is at the forefront of digital transformation among African banks. However, defects such as slow response of legacy systems and insufficient adaptation of new products can no longer effectively support the development of digital business. Based on NCBA's system status and business goals, MuRong Technology deployed a next-generation digital banking core business system for NCBA Bank, providing end-to-end product solutions covering mobile deposits, online loans, digital payments and Super App, strongly supporting its digital business transformation and innovation.

Through deepening digital transformation, NCBA Bank has not only successfully expanded its digital banking business in Kenya, but also continued to promote the development of inclusive finance in Africa. With technological innovation and strategic cooperation, NCBA is gradually establishing its position as a leader in digital financial services in Africa.

Since its launch in 2021, NCBA has relied on leading digital banking products to maintain an average annual business growth rate of 20-30%. As of 2024, NCBA has provided digital financial services to more than 50 million customers in Kenya alone.

As a regional financial group, NCBA's digital banking business has expanded from Kenya to Tanzania, Rwanda, Ethiopia, Uganda, Côte d'Ivoire, Ghana and other countries.

2. Kenya Commercial Bank (KCB) (Kenya)

KCB implemented an innovative digital transformation solution through "MuRong IDO",

quickly put the digital banking system into production and achieved business integration with the existing core banking system (T24),

setting a model case for digital transformation of large commercial banks.

Cross-border expansion:

Implemented and expanded in Kenya, Tanzania, Uganda, Rwanda, South Sudan, Burundi and other countries.

Innovative digital ecosystem:

Provides capabilities such as online account opening, multi-factor security authentication and intelligent customer service,

supporting diversified scenarios such as bill payment (water, electricity, gas), education payment and e-commerce platforms.

Personalized services:

Supports multi-language and multi-theme customization and provides responsive customer service.

Technical architecture advantages:

Cloud-native and microservice architecture achieves elastic resource expansion, real-time transaction processing and full-link monitoring.

As the largest commercial bank in East Africa by asset size, KCB faced challenges such as traditional core banking systems restricting business innovation,

customer experience and cross-regional expansion and chose to carry out technical cooperation with MuRong Technology. After a comprehensive evaluation, the two parties adopted the "Fusion" model solution: with the help of MuRong IDO, the digital banking system was quickly put into production and efficient data interfaces were used to achieve business synergy with the core banking system.

This project not only successfully solved KCB's current technical bottlenecks, but also delivered substantial commercial value and technical breakthroughs that includes.

Cross-border expansion:

Implemented and expanded in Kenya, Tanzania, Uganda, Rwanda, South Sudan, Burundi and other countries.

Innovative digital ecosystem:

Provides capabilities such as online account opening, multi-factor security authentication and intelligent customer service,

supporting diversified scenarios such as bill payment (water, electricity, gas), education payment and e-commerce platforms.

Personalized services:

Supports multi-language and multi-theme customization and provides responsive customer service.

Technical architecture advantages:

Cloud-native and microservice architecture achieves elastic resource expansion, real-time transaction processing and full-link monitoring.

This case proves MuRong Technology's technological innovation and product advantages and provides a highly referential practical model for the digital transformation of traditional financial institutions:

Through reasonable solution design and mature implementation strategies, financial institutions can quickly achieve digital transformation while maintaining business integrity and continuity.

3. China Construction Bank (China)

China Construction Bank successfully expanded multi-industry ecosystem services through "MuRong IDO",

significantly increased transaction scale and operating benefits and consolidated its leading advantage in the financial field.

China Construction Bank is China's second largest commercial bank. As a traditional commercial bank, China Construction Bank is keenly aware of the importance and urgency of digital transformation. It has established technical cooperation with MuRong Technology since 2018. MuRong Technology implemented a secure, flexible and open digital banking system for it, helping CCB to take the lead in putting the digital banking platform into production and successfully launching online financial business. Through continuous system construction and upgrades, digital banking business has been deeply integrated into CCB's core business system,

which has not only significantly improved customer experience, effectively reduced operating costs and expanded diversified service scenarios, but also enabled China Construction Bank to maintain its leading advantage in the digital finance field. Below are some highlights;

As of 2024, the transaction amount exceeded 480 billion yuan.

Provided more than 200 product functional modules, served more than 100 large industry customers and supported 80,000 merchants.

Covered dozens of industry ecosystems such as e-commerce, exchanges, new retail, automobile sales, airports and government taxation.

During the "618" and "Double 11" shopping festivals, it withstood a peak of tens of thousands of transactions per second with zero failures throughout the process.

4. China Telecom (China)

Based on its huge mobile user base, China Telecom successfully expanded its business boundaries by building a digital banking system through "MuRong DBS",

providing a large-scale successful case for non-bank institutions to carry out financial business.

As of the end of 2024 of Orange Finance and BestPay has shown remarkable performance. Below are some highlights:

User scale:

The number of registered users exceeded 600 million, with more than 50 million monthly active users.

Transaction scale:

The total transaction volume exceeded 2 trillion yuan, of which the annual credit transaction volume was about 100 billion yuan.

Inclusive finance:

Covered online credit, bill payment, online and offline consumption, living expenses payment and other financial services.

As one of China's three major telecom operators, China Telecom has laid out the digital finance field through its "Orange Finance" and "BestPay" platforms. Since 2016, MuRong Technology, as its core partner, has continuously provided customized digital banking solutions and successfully helped China Telecom achieve a qualitative leap in its financial business: By building a complete digital banking system,

China Telecom has not only achieved comprehensive expansion of comprehensive financial services such as online loans, bill payments, consumption, wealth management and digital insurance, but also built a complete digital financial ecosystem.

As of the end of 2024 of Orange Finance and BestPay has shown remarkable performance. Below are some highlights:

User scale:

The number of registered users exceeded 600 million, with more than 50 million monthly active users.

Transaction scale:

The total transaction volume exceeded 2 trillion yuan, of which the annual credit transaction volume was about 100 billion yuan.

Inclusive finance:

Covered online credit, bill payment, online and offline consumption, living expenses payment and other financial services.

China Telecom has developed into a leading digital financial service platform in China. Its practice of expanding financial business through technical cooperation provides a benchmark case for non-bank institutions.

Digital Wallet and Payment Application Cases

1. Lakala (China)

Lakala has successfully upgraded its core business system through "MuRong DBS", effectively solved technical bottlenecks, significantly improved business processing efficiency and expansion capabilities and provided strong support for the development of digital financial business.

Lakala has successfully upgraded its core business system through "MuRong DBS", effectively solved technical bottlenecks, significantly improved business processing efficiency and expansion capabilities and provided strong support for the development of digital financial business.

Lakala is a leading digital financial business service provider for merchants in China. In the process of rapid business expansion, its original technical architecture and core system have shown performance bottlenecks: problems such as insufficient transaction processing capacity,

limited business scalability and declining response efficiency have become increasingly prominent, making it difficult to effectively support Lakala's rapid development needs.

In response to this challenge, Lakala chose to cooperate with MuRong Technology, which has rich experience in the digital banking field.

MuRong Technology provided a professional digital payment overall solution, focusing on reconstructing and expanding Lakala's core business system PayMax. After the system was put into production: transaction efficiency was greatly improved,

customer experience was significantly improved and unified business operations were achieved. This solution not only solved the original technical bottlenecks, but also laid a solid foundation for Lakala's future business development.

As of the end of 2023, the transaction amount of bank card acquiring reached 3.31 trillion yuan and its market share remained industry-leading.

In the field of small and micro merchants, Lakala covered more than 27 million small and micro merchants, with a market share of more than 25%,

ranking first in the industry; in the smart POS market, the deployment volume of smart terminals in industries such as catering and retail ranked top two, accounting for about 22%.

Cross-border payment transactions reached 43.1 billion yuan, an increase of 108% compared with 2022 and the cumulative number of merchants served exceeded 70,000.

2. Bank of China Macau Branch (Macau, China)

Bank of China Macau Branch innovatively launched Macau's first aggregated payment platform, integrating multiple payment methods, improving security and convenience and leading the development of local mobile payments.

Bank of China Macau Branch innovatively launched Macau's first aggregated payment platform, integrating multiple payment methods, improving security and convenience and leading the development of local mobile payments.

BOC Macau Branch keenly identified the fragmented user experience caused by the complexity of payment types and channels in Macau.

To this end, the bank joined hands with MuRong Technology and effectively developed Macau's first "All in One" aggregated payment product relying on MuRong Technology's leading digital banking system.

This product achieved three innovative breakthroughs:

1. Integrated QR code payments from mobile banking, Alipay, WeChat and UnionPay QuickPass;

2. Compatible with card payments from Visa, MasterCard and UnionPay;

3. Significantly improved payment security and operational convenience through technological upgrades, bringing a truly one-stop payment experience to Macau residents.

Thanks to this, as of 2024, Macau's mobile payment market has shown continuous growth: the total number of transactions reached 350 million, an increase of 17% from 300 million in 2023. MuRong Technology's payment system provided great support for this business,

fully verifying the huge commercial value of the "All in One" aggregated payment product.

3. Newland (China)

Newland built an efficient and secure distributed digital payment system, strengthened the competitiveness of terminal products through technological innovation and consolidated its leading position in the global market.

Newland built an efficient and secure distributed digital payment system, strengthened the competitiveness of terminal products through technological innovation and consolidated its leading position in the global market.

As a global leader in digital payment terminal sales, Newland has always actively explored breakthroughs in intelligence, digitalization, multi-scenario integration and technological innovation to consolidate its market-leading position.

In 2018, Newland reached a strategic cooperation with MuRong Technology to jointly promote the innovation of digital payment technology and products.

As a global leader in digital payment terminal sales, Newland has always actively explored breakthroughs in intelligence, digitalization, multi-scenario integration and technological innovation to consolidate its market-leading position.

In 2018, Newland reached a strategic cooperation with MuRong Technology to jointly promote the innovation of digital payment technology and products.

Based on a distributed microservice architecture, MuRong Technology built a highly available, elastic and scalable digital payment system for Newland. This system built an efficient payment bridge between consumers, merchants and financial institutions. It fully supports the transaction needs of various commercial scenarios such as bank card acquiring and QR code payments,

ensures transaction security and stability and helps it continue to launch terminal products and maintain market competitive advantages.

Digital payment business covers more than 130 countries and regions worldwide.

Ranked first in global digital payment terminal sales and top three in China's payment transaction scale.

As of the end of 2024, the annual total transaction volume exceeded 2 trillion.

Summary

As a professional digital financial IT solution provider, MuRong Technology has helped more than 100 commercial banks, financial technology companies and telecom operators achieve business breakthroughs and consolidate their market-leading positions in the global wave of digital banking development,

fully demonstrating MuRong Technology's technical strength and product value in promoting the digital transformation of the financial industry.

Future Outlook

MuRong Technology's R&D Direction

In the future, with the promotion of new technologies such as big data and artificial intelligence, the development of digital banking will usher in broader space. MuRong Technology will continue to deepen technological innovation,

provide customers with more efficient and intelligent digital banking products and solutions and help financial institutions continue to transform and upgrade.

Intelligence:

Generative AI will reshape customer service, drive intelligent customer service, risk control and personalized services and improve efficiency and user experience.

Data Empowerment:

Establish a big data platform to mine data value, support precision marketing, risk management and product innovation.

Open Ecosystem:

Build a financial scenario industry ecosystem through open API cooperation with third parties.

Financial Inclusion:

Technology reduces costs, expands the coverage of financial services and benefits global SMEs and rural users.

Global Market Cooperation

With innovative digital banking products as the core driving force, MuRong Technology continues to expand the global financial services field, focusing on deeply cultivating emerging digital financial markets.

We help partners achieve business upgrades and promote the global development of inclusive finance by providing an efficient and secure digital financial product system. In the future, we will accelerate the strategic layout in three major regions:

Africa, Southeast Asia and Latin America and inject technological momentum into global digital economic development by deepening local financial digital transformation.