The Merchant Acquiring Business is Undergoing Profound and Continuous Changes

Against the backdrop of rapid global digital economic development, the acquiring business is experiencing a profound transformation and upgrade. The current market exhibits dual characteristics: sustained scale expansion and deep ecosystem integration. With innovations in payment technology, shifts in consumer behavior, and evolving merchant demands, the acquiring business has transitioned from traditional payment processing to a more comprehensive, intelligent, and scenario-driven model.

Changes in Payment Methods and Habits

Today’s consumers demand greater convenience and immediacy, with embedded payments (e.g, social, e-commerce, BNPL) becoming a new trend. This compels acquiring institutions to deliver seamless omni-channel payment experiences.

Upgraded Merchant Demands

Merchant needs have evolved from simple payment acceptance to comprehensive "omni-channel, multimodal" solutions. Acquiring systems must now transform payment data into business value, including omni-channel integration (online + offline), value-added services (automated reconciliation, membership marketing), and full-network support.

Intensified Competition

Traditional banks, PSPs,

and fintech companies now compete on the same stage,

with technology as the core driver.

Fierce market competition demands not only rapid product iteration and adaptability

but also the ability to precisely meet the personalized needs of diverse user segments.

Additionally,

heightened competition has led to a continuous decline in merchant discount rates (MDR),

squeezing acquiring institutions' profit margins. Leading e-commerce platforms

and chain retailers demand lower rates and customized solutions,

driving a shift from standardized to tailored pricing models

and forcing acquirers to balance service upgrades with cost control.

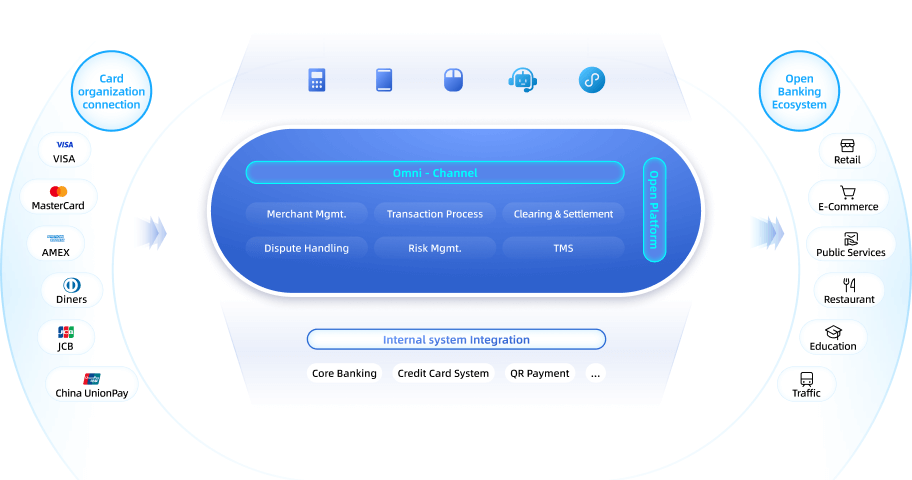

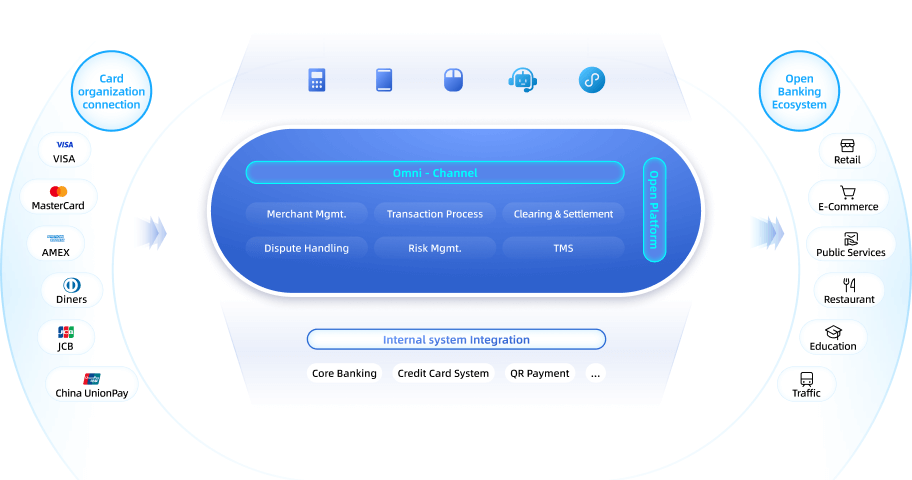

Digital Transformation in Financial Services Provides New Growth Opportunities for Acquiring

The rapid advancement of digital banking and financial technology is reshaping the merchant acquiring landscape. Payment methods are shifting from cash and cards to mobile payments, digital wallets, and biometric authentication. While transaction processing remains foundational, open banking and API ecosystems are enabling deeper collaboration and integration, linking acquiring services with e-commerce, public services, transportation, and government. Throughout this evolution, scenario-specific payment solutions and cross-industry ecosystem partnerships are emerging as key growth drivers.

Architecture priorities for acquiring platforms

To respond effectively, acquiring platforms must execute a two-pronged digital transformation. First, establish open API platforms to expand ecosystem connectivity and support rapid, merchant-specific customization. Second, advance the transition to microservices and containerized architectures to enhance agility and scalability. These capabilities will accommodate the diversification of payment methods and the fragmentation of usage scenarios while meeting the personalized needs of distinct user segments, thereby sustaining competitive advantage in acquiring.

AI-enabled operations

AI technologies are materially enhancing acquiring operations. Machine learning enables real-time monitoring and intelligent interception of transaction risks, significantly strengthening fraud prevention. In parallel, AI-powered customer service provides 24/7 support through conversational interfaces, improving user experience and accessibility, including for elderly and other vulnerable users.

Core capability enhancements from digital transformation in acquiring

Challenges of Legacy Merchant Acquiring Systems

The merchant acquiring business must accelerate digitalization and ecosystem integration. Yet many banks still operate legacy platforms that constrain progress. Traditional monolithic systems cannot accommodate increasingly diverse payment methods. Aging architectures impede integration and slow product delivery. At the same time, heightened regulatory expectations expose gaps in risk management and compliance. These bottlenecks limit innovation and delay transformation in acquiring.

Key challenges and required capabilities

MuRong Technology’s Merchant Acquiring System

Leveraging deep insight into global acquiring trends and the limitations of legacy platforms, MuRong Technology has introduced MuRong MAS (an open, omnichannel merchant acquiring system). The solution delivers comprehensive, future-ready platform and technology capabilities to address core challenges across the acquiring value chain.

MuRong MAS

employs a distributed microservices architecture and supports flexible cloud deployment. The platform scales horizontally and enables agile delivery to respond quickly to market changes. It integrates core functional modules, including the payment gateway, transaction engine, risk management, clearing and settlement, and compliance management. In addition, the platform incorporates AI to enable intelligent risk control and customer service assistance. Through open APIs that support multi-industry ecosystem integration, MuRong MAS provides a modern end-to-end acquiring solution that combines intelligent services with an open ecosystem, addresses core industry challenges, optimizes operating costs, and supports sustainable business growth.

MuRong MAS: Core capabilities and Business value

• Aggregated payment methods (cards, QR codes, e-wallets, Apple Pay, etc.)

• National and regional switches

• International payment schemes

• Payment acceptance devices and core systems

• Efficient cross-border and multi-currency processing

• Automated reconciliation and report generation

• Personalized configuration

• Multidimensional data analytics

• Flexible customized fee solutions

• Automated reconciliation

• DevOps deployment

• Automated compliance engine

• Preconfigured international regulatory standards (AML, PCI DSS)

• Dynamic rapid scaling capability

Global Implementation of MuRong MAS

MuRong MAS has gained extensive recognition globally, with a client base that includes central banks, large commercial banks, and specialized payment institutions.

China market deployments

Bank of Communications

As one of China’s top five commercial banks, Bank of Communications has fully adopted the MuRong MAS platform to support its acquiring operations. The system manages approximately 600,000 POS terminals, with daily transaction volumes exceeding 18 million.

China Bohai Bank

China Bohai Bank, a national joint-stock commercial bank, deployed MuRong MAS to optimize merchant payment acceptance. Following go-live, transaction processing efficiency improved significantly.

Lakala

Lakala, a leading provider of digital financial services for merchants in China, adopted MuRong MAS to enhance omnichannel acquiring, with strong technical support for QR code payments. According to Lakala’s 2024 financial report, the company’s total annual payment transaction volume reached RMB 4.22 trillion, including:

• QR code transaction volume of RMB 1.36 trillion, a year-on-year increase of 13.27%.

• Bank card transaction volume of RMB 2.86 trillion, reflecting continued market share gains.

• Cross-border payment transaction volume totaling RMB 49.2 billion, up 14% year-on-year.

• Foreign card transaction volume growing 4.4 times year-on-year, covering 285 cities across China.

Newland

Newland, a global leader in digital payment terminal sales, leveraged MuRong Technology’s solution to optimize its online acquiring network and enhance global service capability. Its digital payment business spans more than 130 countries and regions, ranking among the top three in China by payment transaction volume. According to Newland’s 2024 annual report and related disclosures:

• 2024 payment service transaction volume exceeded RMB 2 trillion, with QR code payments accounting for 94%.

• Cumulative cross-border payment transaction volume surpassed RMB 120 million, with a foreign currency acceptance network covering 331 cities across China and 12 key industries, and deep collaboration with six major international card schemes.

• The acquiring system’s processing capacity increased to 80 million daily transactions, supporting concurrency of 10,000 transactions per second.

Global expansion and overseas cases

MuRong Technology’s acquiring solutions have demonstrated strong performance in the domestic market and achieved exceptional results in overseas expansion. The company’s products have been deployed across Asia, Africa, and North America.

NIBSS (Nigeria Inter-Bank Settlement System)

The Nigeria Inter-Bank Settlement System (NIBSS), a subsidiary of the Central Bank of Nigeria, implemented the MuRong MAS platform and established a comprehensive payment card infrastructure within six months. As the core hub of the national payments ecosystem, this deployment highlights MuRong Technology’s ability to deliver national-level financial infrastructure.

• Established a complete card switch and card issuance system.

• Designed an independent set of card transaction specifications.

• Completed POS, ATM, and web business transactions for more than twenty banks.

• Built an independent real-time clearing system.

• Implemented an agency authorization payment system.

• Delivered a rapid-response regulatory monitoring system.

• POS terminal volume exceeding 11 million.

• Throughput greater than 200 transactions per second.

NCBA (Kenya)

NCBA, Kenya’s third-largest bank, adopted MuRong MAS, achieving sustained business growth averaging 20 to 30 percent annually and accelerating its expansion within Africa’s payments market.

SnapPay (Canada)

SnapPay, a prominent Canadian payment service provider, deployed MuRong MAS in North America to strengthen merchant payment processing and risk management. The platform enables rapid integration with local mainstream payment methods while complying with Canada’s financial regulations, providing a technological foundation for business growth.

Bank of China Macau Branch

Bank of China Macau Branch implemented MuRong MAS to establish Macau’s first All-in-One Aggregated Payment platform. The solution enhanced payment service capabilities and delivered a seamless omnichannel experience, driving market share growth from 3 percent to 35 percent within six months, with daily transaction volumes exceeding 500,000.

Global Implementation of MuRong MAS

MuRong MAS has gained extensive recognition globally, with a client base that includes central banks, large commercial banks, and specialized payment institutions.

China market deployments

Bank of Communications

As one of China’s top five commercial banks, Bank of Communications has fully adopted the MuRong MAS platform to support its acquiring operations. The system manages approximately 600,000 POS terminals, with daily transaction volumes exceeding 18 million.

China Bohai Bank

China Bohai Bank, a national joint-stock commercial bank, deployed MuRong MAS to optimize merchant payment acceptance. Following go-live, transaction processing efficiency improved significantly.

Lakala

Lakala, a leading provider of digital financial services for merchants in China, adopted MuRong MAS to enhance omnichannel acquiring, with strong technical support for QR code payments. According to Lakala’s 2024 financial report, the company’s total annual payment transaction volume reached RMB 4.22 trillion, including:

• QR code transaction volume of RMB 1.36 trillion, a year-on-year increase of 13.27%.

• Bank card transaction volume of RMB 2.86 trillion, reflecting continued market share gains.

• Cross-border payment transaction volume totaling RMB 49.2 billion, up 14% year-on-year.

• Foreign card transaction volume growing 4.4 times year-on-year, covering 285 cities across China.

Newland

Newland, a global leader in digital payment terminal sales, leveraged MuRong Technology’s solution to optimize its online acquiring network and enhance global service capability. Its digital payment business spans more than 130 countries and regions, ranking among the top three in China by payment transaction volume. According to Newland’s 2024 annual report and related disclosures:

• 2024 payment service transaction volume exceeded RMB 2 trillion, with QR code payments accounting for 94%.

• Cumulative cross-border payment transaction volume surpassed RMB 120 million, with a foreign currency acceptance network covering 331 cities across China and 12 key industries, and deep collaboration with six major international card schemes.

• The acquiring system’s processing capacity increased to 80 million daily transactions, supporting concurrency of 10,000 transactions per second.

Global expansion and overseas cases

MuRong Technology’s acquiring solutions have demonstrated strong performance in the domestic market and achieved exceptional results in overseas expansion. The company’s products have been deployed across Asia, Africa, and North America.

NIBSS (Nigeria Inter-Bank Settlement System)

The Nigeria Inter-Bank Settlement System (NIBSS), a subsidiary of the Central Bank of Nigeria, implemented the MuRong MAS platform and established a comprehensive payment card infrastructure within six months. As the core hub of the national payments ecosystem, this deployment highlights MuRong Technology’s ability to deliver national-level financial infrastructure.

• Established a complete card switch and card issuance system.

• Designed an independent set of card transaction specifications.

• Completed POS, ATM, and web business transactions for more than twenty banks.

• Built an independent real-time clearing system.

• Implemented an agency authorization payment system.

• Delivered a rapid-response regulatory monitoring system.

• POS terminal volume exceeding 11 million.

• Throughput greater than 200 transactions per second.

NCBA (Kenya)

NCBA, Kenya’s third-largest bank, adopted MuRong MAS, achieving sustained business growth averaging 20 to 30 percent annually and accelerating its expansion within Africa’s payments market.

SnapPay (Canada)

SnapPay, a prominent Canadian payment service provider, deployed MuRong MAS in North America to strengthen merchant payment processing and risk management. The platform enables rapid integration with local mainstream payment methods while complying with Canada’s financial regulations, providing a technological foundation for business growth.

Bank of China Macau Branch

Bank of China Macau Branch implemented MuRong MAS to establish Macau’s first All-in-One Aggregated Payment platform. The solution enhanced payment service capabilities and delivered a seamless omnichannel experience, driving market share growth from 3 percent to 35 percent within six months, with daily transaction volumes exceeding 500,000.

Summary and Future outlook

MuRong Technology offers comprehensive global implementation capabilities that support rapid deployment and local compliance:

• Multilanguage interfaces and multi-currency settlement to meet worldwide business requirements.

• Localized adaptation to diverse regulatory frameworks across countries and regions.

• A global service network that provides timely, efficient technical support.

These integrated capabilities enable MuRong Technology’s solutions to adapt quickly and deploy successfully across markets.

As global digital transformation accelerates, merchant acquiring systems, as critical payment infrastructure, are shifting from basic transaction processing to interconnected, intelligent service platforms. MuRong MAS is designed for this shift with open APIs, a distributed microservices architecture, and embedded AI. Through worldwide deployments, the platform has demonstrated clear value: improving transaction efficiency, lowering compliance effort and cost, and expanding ecosystem participation. These capabilities equip financial institutions with a proven path to modernize acquiring, unlock new revenue opportunities, manage risk more effectively, and advance their digital transformation agendas.