About NUCC

Established in 2017, NetsUnion Clearing Corporation (NUCC) is the central bank of China (a People’s Bank of China)-owned enterprise, operating under its direct management.

NUCC builds and operates a national unified clearing system,

supports one-point access for non-bank payment institutions and commercial banks, facilitates fund settlement, resolves disputes,

and provides information transmission, along with ancillary services such as authentication and inquiry services.

Risks and Challenges Arising from Business Growth

However, with the development of computer and Internet technology,

mobile payment and digital shopping have ushered in an outbreak,

leading to a rapid growth in the scale of e-payment transactions,

which is a revolution in the payment field and poses a great challenge to NUCC’s clearing system.

The challenges come from two aspects:

✔ From technology perspective:

Failures and Attacks: With the increasing complexity of the payment

clearing system and the continuous expansion of the transaction scale,

the frequency of technical failures and Network attacks has increased.

Concurrent Performance Issues: With the increase in transaction volume,

the transaction system needs to handle a large number of user requests and do the corresponding business processing,

which will put great pressure on the system performance.

Data Consistency: The decision-making of the clearing organization must be made on the basis of account data,

transaction data, time stamps and other information, so data consistency is very important,

and the high transaction environment may lead to data inconsistency leading to potential risks of transaction failure.

✔ From business perspective:

Account and Transaction Risk: With the growth of transaction scale and the complexity of business logic,

the risk of illegal account intrusion, data tampering and fund transfer is also on the rise.

Complexity of CLS Processing:

Increasingly complex business processes require high concurrency in CLS to ensure the accuracy and integrity of transactions between multiple parties.

Risks Control: Market manipulation may become more insidious in a high-trading-volume environment,

and identification and prevention will become more complicated.

How to Build a World-leading Digital Ecosystem

Against this backdrop, NUCC must increase its investment in payment infrastructure construction,

especially modernizing its core funds clearing system, so as to meet the growing business and service demands.

After many researches and evaluations, NUCC finally chose to cooperate with MuRong Technology based on the following reasons:

1. MuRong has a mature technology architecture and leading digital payment product solutions,

which can effectively respond to the challenges faced by NUCC.

2. MuRong Technology has professional and excellent project management and implementation delivery capabilities,

which makes the project delivery process greatly improved.

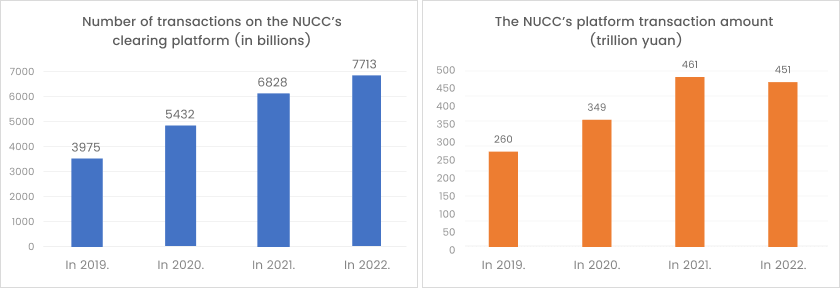

The World’s Leading Transaction Capability

NUCC swiftly upgraded and expanded its core fund clearing system with the full cooperation of MuRong Technology team.

The upgraded system has gained unparalleled performance and functionality,

helping NUCC become the largest retail payment clearing organization in the world in terms of transaction volume.

Visa’s clearing processing capacity was at 24,000 transactions/second in 2018, with peak processing capacity of about 65,000 transactions/second under the lab,

and the peak transaction value of the European fast payment system was 500 transactions/second.

The peak data of NUCC on the day of “Double Eleven” in 2018 was 92,000 pens/sec,

and its successful processing cases have set a record for the actual processing of concurrent peaks by clearing organizations in the international arena.

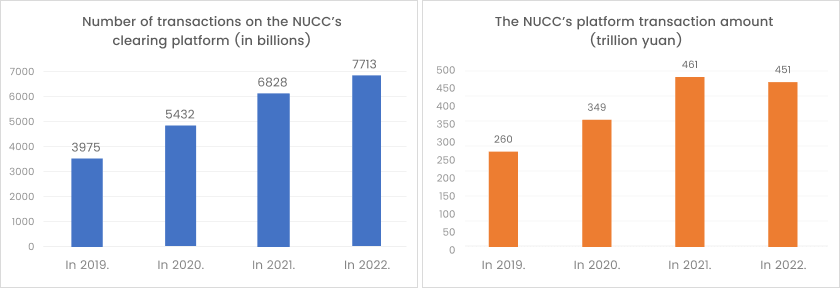

In recent years, NUCC core fund clearing system supported by MuRong Technology has been refreshing the historical peak again and again. As of 2023,

NUCC clearing handles 2.5 billion online payment transactions on average per day, and reaches 100% in terms of the system success rate,

fund clearing accuracy rate, and fund clearing timeliness rate.

(Data source: People’s Bank of China official website

)

Benefits

Robust Business Processing Capability: funds clearing and processing capability for large-scale transactions under high concurrency;

powerful configuration function to support various CLS modes;

flexible coordination capability to realize multi-party data interaction and ensure the accuracy and integrity of CLS.

Distributed Cloud Computing Architecture: It supports the construction of multi-point and multi-live data centers in multiple regions,

and realizes the second-level automatic cut flow of server,

network and database layer failures to ensure that the failure recovery capability is at the leading level.

High Concurrency and Responsiveness: The platform design takes full account of the technical requirements of high concurrency and high availability,

and is capable of efficiently handling a large number of high-frequency payment businesses.

Safeguard Account Security: The platform utilizes risk management and intelligent risk control to effectively monitor fund flows and prevent unclear and non-compliant fund movements.

Future Outlook

As a modernized payment clearing institution of the central bank,

NUCC has significantly improved the efficiency of fund clearing and settlement, and has become the mainstay of China’s payment clearing system.

In the future, with the development of the payment industry,

NUCC clearing will usher in a broader development space. At the same time, with the continuous emergence of new technologies such as AI and blockchain,

and the strengthening of regulatory policies, NUCC will also face more technical challenges and competition.

In order to meet these challenges, NUCC still needs to continuously innovate and optimize its technology and services:

More flexible payment products covering the needs of a wider range of people;

Higher scalability, lower operating costs;

More intelligent and digitalized operation and risk control capability.

As an excellent partner for many years, MuRong Technology will continue to bring more solutions and support to NUCC, helping NUCC maintain its rapid development trend and jointly realize the grand vision in the payment field.