About Chengfang Fintech

Chengfang Fintech(CFIT), a Beijing-based company established in 2020 and funded by a unit of the central bank of China,

People’s Bank of China (PBOC), specializes in financial technology services.

It is responsible for the operation and maintenance of the central bank’s information systems,

including the construction, operation, and maintenance of central bank’s backbone network,

the execution of resource scheduling and operational management for the central bank’s network and various data centers,

the operation of the central bank’s data exchange management platform, and the provision of network communication,

infrastructure, system maintenance, and data exchange services for the entire system.

Challenges and Solutions

As a financial technology company under the central bank of China, it has extraordinary significance and mission:

Support the core business of the central bank and ensure the smooth operation and development of the business.

Empower finance with technology and provide new products and services for the central bank.

Protect the data network and information system security of the central bank.

In order to better fulfill its responsibilities, it needs to adopt strict technical requirements and product standards to improve its product technology capabilities.

To this end, CFIT urgently needed an experienced technical team proficient in central bank product solutions to assist it in ensuring the stable and efficient implementation and upgrading of the central bank’s core business systems.

After several rounds of selection and evaluation, MuRong Technology,

with its leading solutions in central bank core system and excellent service reputation in the industry,

finally stood out and became the best partner of CFIT.

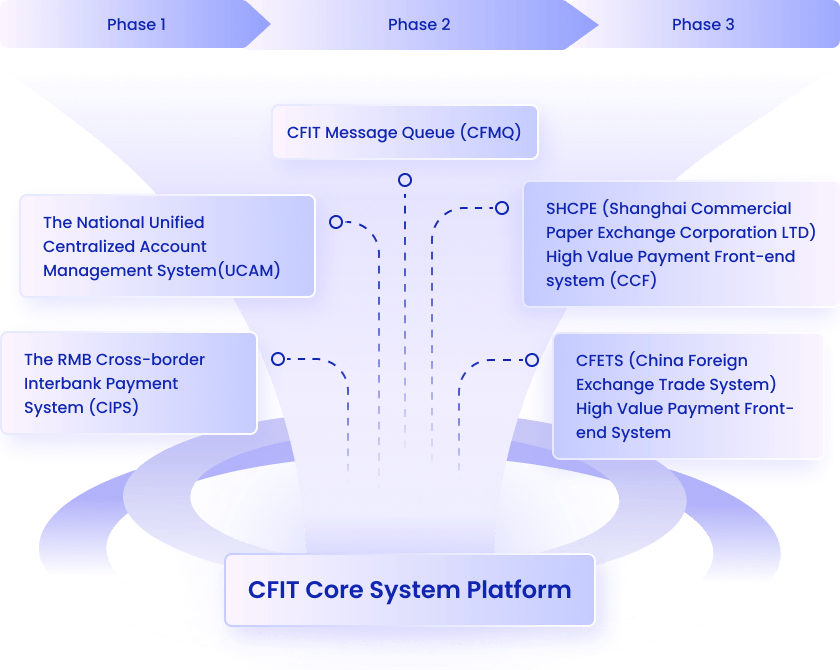

Cooperative Implementation

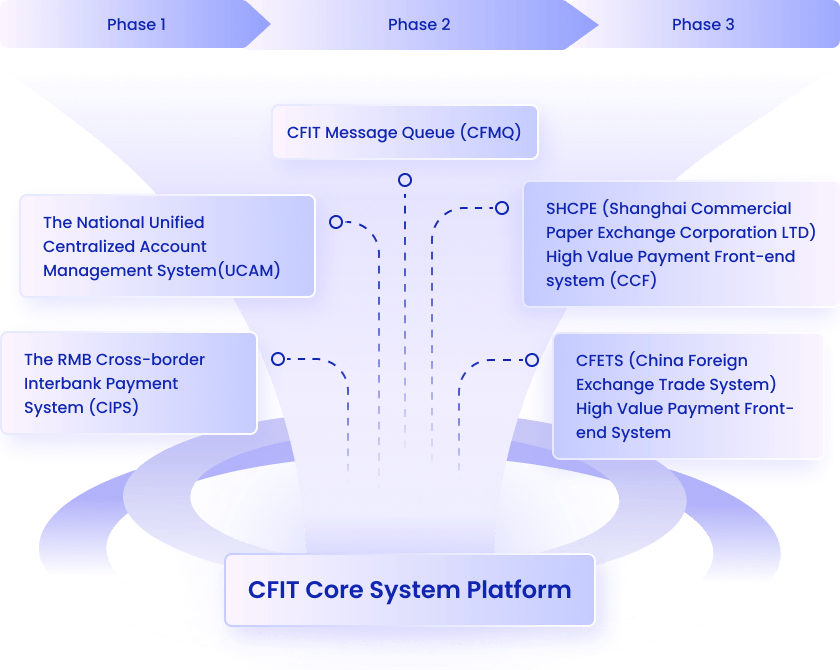

MuRong Technology dispatched the implementation team with rich experience. After a comprehensive analysis and assessment of the platform and system status of CFIT,

a tailored technology upgrade plan was created to best suit their needs.

In coordination with Fangcheng Fintech, several core business system upgrades and transformation projects have been successfully designed and implemented.

Deliverables

The National Unified Centralized Account Management System (UCAM) integrated with existing account systems,

has formed a national centralized “Big System” with unified external access,

internal business synergy and information sharing.

With the RMB Cross-border Interbank Payment System (CIPS), the core system has been optimized and upgraded to further enhance the integration of RMB CBPS channels and resources,

improve the CBPS efficiency, meet the requirements of the RMB business development in all major time zones,

increase transaction security, and establish a fair market competition environment.

Chengfang Message Queue (CFMQ), independently developed, is a full-featured and high-performance MQ system that supports automated one-click and cloud-native deployment, visualized monitoring,

and is applied to platforms of financial critical infrastructure, securities, and banks.

The overall real-time throughput of the system exceeds 10,000 pens/sec,

and the maximum daily message volume of a single instance reaches 165G, which is about 4 times higher than similar commercial products.

SHCPE(Shanghai Commercial Paper Exchange Corporation LTD) and CFETS(China Foreign Exchange Trade System) High Value Payment Front-end System is built with the latest software development technology in accordance with the payment business and relevant interface standards,

which can be seamlessly connected with various peripheral systems, send and receive data in a unified manner,

and realize the centralized initiation of the high value payment business, automatic bookkeeping and accounting of the back-end core, and the automatic supervision and reporting of the transaction data, and other business requirements.

Benefits

Since the cooperation began, CFIT has gained more and more benefits with the continuous support of professional knowledge and experience of MuRong team:

Thanks to MuRong’s cloud-native platform design solution and rich product experience,

CFIT is able to build products quickly so as to adapt to the ever-changing market demands.

Relying on MuRong’s professional team support, CFIT can focus more on business expansion and product improvement,

and can spend less time on managing the underlying core technology.

MuRong provides more innovative technologies and automation tools,

thus supporting PBOC’s core business operations in a simple, efficient and cost-effective way.

Actively promoting regulatory technology, using big data, AI and other technologies, MuRong enhances the regulation of financial business,

prevents and resolves financial risks in the payment field, and maintains financial security.

Future Outlook

In the future, as the cooperation between the two companies deepens,

MuRong will utilize its own technological advantages and continuous empowerment to provide CFIT with more technological innovation services as well as solutions for new demands under the digital ecology,

helping CFIT to stay ahead of the curve in the highly competitive market.