Digital Transformation as an Inevitable Choice for Banks

In recent years, digital transformation has become an essential path for commercial banks to address market competition and enhance operational efficiency. Through digital transformation, commercial banks can achieve three core values, namely:

- Expand market boundaries to reach a broader customer base.

- Enhance intelligent capabilities, improving customer experience through efficient transaction processing and personalized financial solutions, which helps create differentiated market advantages.

- Integrate operational systems to significantly reduce operating costs.

Additionally, digital transformation serves as a critical approach to achieving inclusive finance. By leveraging technology to lower the barriers to financial services, more SMEs and individual customers can access convenient financial solutions.

Challenges in Digital Transformation for Banks

While digital transformation delivers substantial benefits, banks face numerous implementation challenges, including core system architecture, product digitalization maturity, IT investment capacity, and project timelines.

Therefore, banks must carefully select transformation paths tailored to their specific conditions. Industry practice has identified three typical digital transformation implementation approaches:

Fully Replace the Core

Some banks opt to completely rebuild their core banking systems, establishing new-generation technical frameworks and business systems that meet digital banking requirements to achieve comprehensive digital transformation. However, this approach entails substantial costs, long timelines and risks associated with system migration and data transfer.

Journey-led Progressive Digitalization

Other banks choose to optimize existing systems to reduce transformation costs and risks. Yet, limitations in traditional architectures and design frameworks often result in suboptimal outcomes. This method typically delivers partial improvements rather than full digital transformation, making it difficult to provide top-tier digital customer experiences and supporting products.

"Greenfield" Approach

Proposed by McKinsey as a digital construction methodology, the Greenfield model recommends that commercial banks build entirely new digital banking platforms from scratch while retaining legacy core banking systems. This dual-track strategy enables rapid digital transformation, supporting product innovation and customer experience upgrades while avoiding operational risks such as business disruptions caused by core system replacements.

The Fourth Model – Fusion Model

Based on extensive practical experience, MuRong Technology has combined the strengths of the "journey-led progressive digitalization” and the "greenfield approach" to develop a groundbreaking solution.

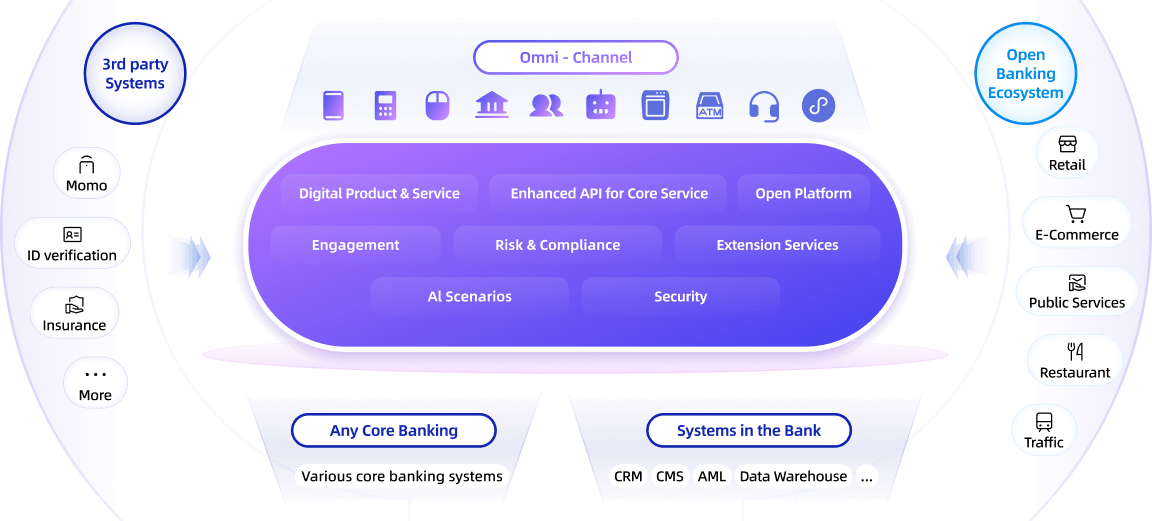

MuRong IDO: The Digital Product Adopting the Fusion Model

MuRong IDO (Innovative and Open Digital Banking System) represents the best practice of the Fusion Model. This system fully supports omni-channel digital banking services and achieves business integration by seamlessly connecting with globally leading core banking systems. This innovative design preserves the rapid transformation advantages of the Greenfield Model while reducing management complexity, ensuring business continuity and enhancing user experience through seamless system integration. It offers banks a modern transformation path that ensures both efficiency and stability.

Core Features of MuRong IDO

branches) to deliver a consistent customer experience.

Core Value of MuRong IDO

Flexible Modular Purchasing:

Supports à la carte module selection, allowing financial institutions to choose mobile banking, open platforms, or other paths based on their transformation stage.

Optimized ROI Model:

Employs phased investment strategies, with key modules delivering results in 6–12 months, boosting operational efficiency and reducing cross-departmental collaboration costs.

Architectural Flexibility and Future Adaptability:

Microservices-based design and containerized deployment ensure the system meets technological demands for the next 5–10 years.

Continuous Innovation Empowerment:

Pre-integrated AI engines and regular upgrades ensure banks remain competitive in a rapidly evolving market.

Rapid Omnichannel Deployment:

A unified product management platform enables "configure once, deploy everywhere," significantly reducing time-to-market for new products.

Global Digital Banking Support:

Multi-language, multi-currency and multi-theme capabilities, facilitate international expansion.

Fusion Model vs. Traditional Transformation Models

Comparison of Digital Transformation Models

Evaluation Indicators:

Recommendations for Fusion Model Adoption

Ideal for:

Dimensions

Core

Digitalization

Approach

Timeline

(2-5 years)

(Continuous)

(6-12 months)

(6-month modular

deployment)

(Legacy System

Constrains)

Strong

(Cloud-Native &

Microservices &Al)

Recommendations for Fusion Model Adoption

Ideal for:

Banks pursuing rapid digital transformation with controlled budgets.

Institutions planning phased digitization.

Banks operating across multiple regions or holding multiple licenses.

Case Study – KCB Digital Transformation Project

As the largest bank in East Africa by assets, KCB implemented MuRong IDO under the Fusion Model, rapidly deploying its digital banking system while integrating with core banking systems. This project stands as a benchmark for large-scale bank digitization.

Outcomes:

- Dramatically improved digital innovation capabilities.

- Significantly reduced product launch cycles.

- Elevated customer experience across all touchpoints.

- Streamlined dual-system operational complexity.

Highlights:

Risk Mitigation:

No business disruption during parallel operations.

Cost Efficiency:

Phased implementation protected legacy investments.

Technical Foresight:

Cloud-native architecture supports continuous iteration.

Ecosystem Expansion:

Open APIs accelerated business innovation.

This project validated the Fusion Model’s applicability in Africa, offering a replicable blueprint for digital transformation. Through this collaboration, KCB not only enhanced operational efficiency but also built future-ready digital financial capabilities.

Conclusion and Future Outlook

Banking digital transformation has entered a critical phase. MuRong Technology’s Fusion Model, powered by MuRong IDO, provides banks with a rapid and secure transformation solution. It ensures business continuity while enabling efficient deployment, effectively addressing the high costs and risks of traditional approaches. Looking ahead, digital banking will evolve toward greater intelligence and openness. AI will deeply empower financial services and open banking ecosystems will accelerate. MuRong Technology will continue refining intelligent services, open platforms and other core technologies to propel the industry into a smarter, more inclusive era.