Background of Digital Banking Evolution

Since the 21st century, the digital economy has surged, with young users favoring digital and mobile banking. Their affinity for digital channels and demand for personalized services have reshaped financial consumer demand.

The advancement of cloud computing, mobile internet, big data, and AI has opened up new possibilities for the banking industry. The application of these technologies enables banks to offer more efficient and personalized services, as well as improved risk management capabilities.

New technologies have reduced the costs of some products and services, enabling banks to extend their reach to previously unserved segments such as SMEs and limited-income individuals, thereby broadening the customer base.

The development of the digital economy has brought new competitive landscape. Fintech companies and Internet platforms have challenged traditional banks by participating in the financial business with the advantages of technology and business models. These new entrants have met consumer demand by offering innovative digital financial products and services.

The Global Digital Banking Development and Innovation Trends Report indicates that the number of digital banks worldwide experienced growth around 2019, with customer base, asset size, and revenues all sustaining rapid growth.

Especially in Asia and South America, digital banks have experienced rapid growth due to large population bases and strong demand for financial inclusion.

Digital banking growth in Africa has also been driven by the popularity of smartphones and the Internet. Digital banking in Africa is experiencing significant growth, as more Africans access banking services through mobile Apps and online banking platforms. Traditional banks are gradually migrating their operations to digital platforms.

Statista, projects the African digital payments market to swell to $195.5 billion by 2024, surpassing its 2020 value by over twofold. It is expected to grow further to $314.8 billion by 2028, growing at a CAGR of 12.65% between 2024 and 2028. Mobile money is the fastest growing form of digital payment in Africa, with platforms such as M-PESA in Kenya and MTN Mobile Money in West Africa becoming household brand names.

The number of mobile money registered accounts in Africa reached 856 million in 2023, representing 49% of global registered accounts, adding 136 million new registered accounts, accounting for more than 70% of the total growth in global registered accounts.

In summary, the changing digital economy and customer requirements, technological advances, and new competitive market landscapes have profoundly impacted and transformed banks and banking industries, with the rapid growth of digital banking globally and the accelerating digital transformation of the banking industry.

What is Digital Banking?

Digital transformation is a major trend and an inevitable choice for industries, with digital banking being the most crucial part and the most direct business manifestation of this transformation.

Digital banks, regarded as financial institutions that primarily offer banking services through the internet or other digital channels, typically do not rely on a physical branch network. Instead, they leverage technology platforms to deliver services, thereby reducing costs, enhancing efficiency, and offering a more convenient user experience.

The rise of digital banks is the result of advances in fintech and changes in consumer behavior. They are transforming the way traditional banking operates and driving innovation and change across the financial industry. The key to differentiate digital banks from the traditional is that, regardless of whether or not they set up branches, they no longer rely on physical branch outlets, but rather use digital networks as the core,

utilizing cutting-edge technologies to provide online financial services. Overall services tend to be customized and interactive, and banking structures tend to be flattened.

Digital banking is characterized by intelligence and online presence, meaning that the bank’s operations and management can be automated online. Thus, digital banking is concrete, not an empty concept. It is not only the channel innovation of traditional banking business, but also the reengineering of overall banking business process,

optimization of organizational structure, innovation of products and services, upgrading of technology system, and the change of end-to-end digital transformation of banks.

Characteristics

We can analyze the characteristics of digital banking from the following aspects:

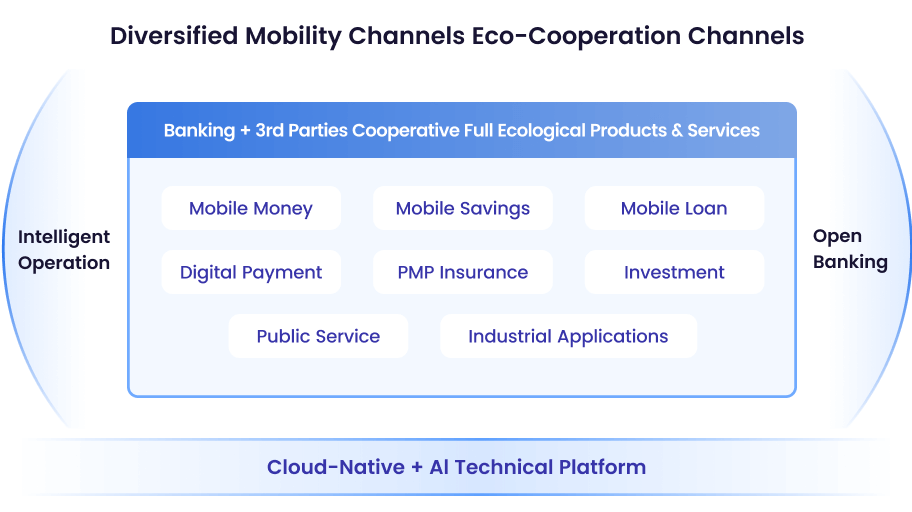

1. Mobilization of Channels

Business entrances include self-service mobile banking (including USSD) and Super App, as well as partner platforms (including operators, travel, retail, etc.). Customers can complete banking services through mobile phones (including smartphones and feature phones).

2. Product Intelligence

The main products of the digital banking include mobile deposits, mobile loans, digital payments, and digital marketing, which are independently operated by commercial banks, as well as third-party products from partners (including operators, insurance companies, fund companies, etc.).

They are all processed automatically by the system without manual intervention, achieving electronic, paperless, and intelligent operation.

3. Operation Digitization

In the past, there were a lot of offline and manual operations. But in the digital banking system, a centralized process engine is used to unify the scheduling of all tasks and process events, and automate the recording of data at each key point to ensure digitization and traceability of the operational process.

Enhance work efficiency while drastically reducing the business error rate, lowering operating costs and improving the input-output ratio.

4. Ecological Openness

In the era of Bank 4.0, banking is all about seamless integration with daily life scenarios, making services ubiquitously accessible, yet never confined to the four walls of a bank branch. By leveraging Open APIs, the banking system not only exposes its own products and services,

but also integrates third-party capabilities through external Gateways. This approach of Open Banking facilitates a two-way exchange - extending the bank’s offerings beyond its walls while also embracing external innovations - to establish a new model of open ecosystem for commercial banks.

5. New Technology System

Leveraging cloud-native technology, the digital banking operations are fully online and run 24/7. The system is designed to have unlimited scalability to accommodate the industry ecosystem. Built on a distributed and microservices architecture, the technical framework effectively addresses the high availability, high concurrency, and high scalability requirements of commercial banks’ digital finance services.

The extensive use of AI technology enhances operational efficiency and strengthens customer service engagement. Furthermore, the integration of cuttingedge internet technologies ensures the security, stability, and reliability of the digital banking system.

Main Operations

Digital banking covers the core business of banking, including but not limited to opening accounts, deposits, transfers, loans, payments, investments and wealth management:

1

Payment

Mobile Money, or E-Wallet, serve as the primary channel for delivering a bank’s payment services, offering customers a variety of services through their mobile applications.

| Offline Consumption | QR payment, NFC payment, and biometric payment such as fingerprint and face. |

| Transfer | Real-time transfers, cross-border transfers, etc. |

| Bill Payments | Utilities (electricity, gas, etc.), insurance, tuition, etc. |

| Airtime | Purchase airtime and data bundles for the phone. |

| Scene Payment | Integrating payment tools seamlessly with specific application scenarios, such as using an app to scan QR codes for payments in public transit like buses and subways, or in healthcare settings. |

Additionally, Mobile Money, or E-Wallet, offers features such as topping up (Cash in), withdrawals (Cash out), and linking bank cards to address issues related to the source of payment funds.

2

Loan

Digital banking loan products typically employ a credit-based lending model, utilizing big data and credit scoring algorithms to extend credit to customers. The entire loan management process is conducted online, ensuring an optimized user experience.

| Consumption Loan | Consumption Loan: Overdraft, supports small overdrafts of the customer’s cash account in consumer scenarios; BNPL (Buy Now Pay Later, and Credit Note), provides loans to customers based on orders. |

| Cash Loan | pure credit cash loans, such as payroll loans and campus loans. |

3

Deposit

Micro-deposit: Leveraging the convenience of mobile apps, digital banks attract customers to place their funds into various types of deposit accounts. These include demand deposits, time deposits, notice deposits, and target deposits, offering flexibility and accessibility to suit different savings needs.

| Intelligent Wealth Management | Intelligent Wealth Management: providing customized wealth management services through the application of data models, big data, machine learning and other technologies. |

| Crypto remittances | Some platforms utilize cryptocurrencies for cross-border payments, providing an alternative to traditional remittance services. |

The digital banking landscape varies significantly across regions due to cultural differences, market dynamics,consumer habits,and regulatory environments.

In China, digital payments have become the most critical application area within digital banking. Banks leverage payment scenarios to build business ecosystems, thereby innovating their products and services. This strategy has led to a proliferation of payment services that are deeply integrated into daily life, making transactions convenient and efficient. In contrast, in Africa, online micro-lending is a priority for commercial banks when it comes to digital transformation.

These banks focus on meeting the financing needs of the general population, particularly those who may be underserved by traditional banking systems. Digital lending platforms offer accessible and quicker solutions to individuals and small businesses. In developed countries, the focus of digital banking is often on the digitization of customer service and the enhancement of customer journeys. Banks aim to expand their reach and strengthen customer interactions by providing a seamless online experience. This approach is designed to offer customers a more personalized and user-friendly experience, with an emphasis on convenience and engagement.

Risks and Challenges

Banks transitioning to digital banking services or expanding their digital offerings often encounter unforeseen risks and challenges. Many of these stem from the rapid evolution of technology, regulatory environments, and customer expectations.

Here are some of the key risks and challenges:

Here are some of the key risks and challenges:

Cybersecurity Threats

Attack Surface Expansion:

As online services proliferate, banks become more vulnerable to cyberattacks.

As online services proliferate, banks become more vulnerable to cyberattacks.

Phishing and Social Engineering:

Despite the presence of advanced security systems, customers can still be tricked into divulging sensitive information, leading to fraud.

Despite the presence of advanced security systems, customers can still be tricked into divulging sensitive information, leading to fraud.

Data Breaches:

Sensitive customer data may be stolen, resulting in economic losses, reputational damage, and legal repercussions.

Sensitive customer data may be stolen, resulting in economic losses, reputational damage, and legal repercussions.

Regulatory and Compliance Issues

Escalating Regulations:

The regulatory environment for digital banking is constantly changing, with new regulations on data protection, cybersecurity and anti-money laundering (AML).

The regulatory environment for digital banking is constantly changing, with new regulations on data protection, cybersecurity and anti-money laundering (AML).

Cross-border Compliance:

As digital banking crosses geographical boundaries, banks must comply with regulations in multiple jurisdictions, which can become complex and costly.

As digital banking crosses geographical boundaries, banks must comply with regulations in multiple jurisdictions, which can become complex and costly.

Technology Integration and Legacy Systems

Legacy System Compatibility:

Integrating new digital platforms with old legacy systems can be difficult, leading to inefficiencies and associated security risks.

Integrating new digital platforms with old legacy systems can be difficult, leading to inefficiencies and associated security risks.

Third-party Dependency:

Banks often rely on thirdparty vendors to provide digital services. Any failure or vulnerability of these third-party systems can directly affect the bank’s operations.

Banks often rely on thirdparty vendors to provide digital services. Any failure or vulnerability of these third-party systems can directly affect the bank’s operations.

Operational Risks

System Stability and Business Continuity:

Any downtime, whether due to technical failures, cyberattacks or system maintenance, can have a significant impact on customer trust and market performance.

Any downtime, whether due to technical failures, cyberattacks or system maintenance, can have a significant impact on customer trust and market performance.

Process Automation Failures:

Automation in digital banking can improve efficiency, but errors in automated processes can lead to significant operational risks, such as erroneous transactions or compliance failures.

Automation in digital banking can improve efficiency, but errors in automated processes can lead to significant operational risks, such as erroneous transactions or compliance failures.

Innovation and Competition

Rapid Technological Change:

The pace of technological change can be such that banks need banks to keep up with the times, and if they don’t innovate quickly enough, they risk ecoming obsolete.

The pace of technological change can be such that banks need banks to keep up with the times, and if they don’t innovate quickly enough, they risk ecoming obsolete.

New Competitors:

The rise of more players, including fintechs and purely digital banks, has intensified competition, forcing traditional banks to innovate while remaining profitable.

The rise of more players, including fintechs and purely digital banks, has intensified competition, forcing traditional banks to innovate while remaining profitable.

Cultural and Organizational Challenges

Resistance to Change:

Employees accustomed to traditional banking methods may resist transitioning to digital, thereby undermining the effectiveness of digital transformation programs.

Employees accustomed to traditional banking methods may resist transitioning to digital, thereby undermining the effectiveness of digital transformation programs.

Skills Gap:

There is a growing demand for employees with digital skills, and banks may struggle to attract and retain such talent.

There is a growing demand for employees with digital skills, and banks may struggle to attract and retain such talent.

Digital Banking Players

Digital banking players are not only commercial banks; fintech companies, Internet companies, and telecom carriers and other such non-financial companies have joined the digital banking field, either by holding some of the banking licenses directly, or by cooperating with the banking business.

We observe that the operating entities of digital banking probably take some of the following forms:

1.Independent Digital Banking Departments Within the Commercial Banking System

Digital banking services are quite different from traditional bank services in terms of customers, products, services, operations, and risks. For example, they have different compliance requirements (like Know Your Customer or KYC),

cater to different customer groups (wallets can be opened for non-bank customers), and operate relatively independently from the traditional banking system, allowing them to run on their own. Banks operate digital banking services as separate business units and product lines,

which facilitates innovation and allows for appropriate risk isolation. Some financial groups even run their digital banking services as independent legal entities, exploring more flexible innovation models.

Examples: AIBANK in China, NCBA Bank’s LOOP in Kenya, Africa, etc

2.Digital Banking Sector of Eco-type Enterprises

Eco-friendly enterprises refer to companies such as internet firms, e-commerce platforms, and telecommunications operators. Leveraging their vast customer base, these companies build rich ecosystems and integrate financial services into their existing business models.

Due to the synergistic effects of financial services, digital banking has become one of the most important components of their business ecosystems. By offering digital banking services like payment transactions and consumer loans, these enterprises further enhance the value and advantages of their ecosystems.

Examples: China's Alibaba and Tencent, as well as Safaricom in Kenya, Africa.

3.Eco-Cooperative Digital Banking Entities

Open collaboration is a characteristic of the digital economy. In the field of digital banking, licensed financial institutions like banks partner with ecosystemoriented companies that have customers and channels. These companies bring in traffic, customers, and scenarios, while banks provide them with banking products,

professional services, and related financial resources. By combining their respective strengths, they offer innovative digital banking products and services to customers.

Examples: Africa Kenya KCB Bank and Safricom cooperation of micro and small loans.

4.Innovative Digital Banking Within Commercial Banks

Banks need to explore digital banking services based on their own circumstances, focusing on specific business scenarios for digitization to control risks and scope. Since this is related to existing resources and closely tied to current customers, businesses, and systems, it is generally not operated as an independent legal entity.

Example: China Construction Bank’s Digital Banking.

Technical Implementation Strategies for Banks Developing Digital Banking Business

Digital banking is a product of technological advancements, and the technological requirements for digital banking systems are significantly different from those of the traditional:

- The digital banking system requires high concurrent processing and high-frequency iteration, which requires the banking system to be able to support a large number of users’ transactions and rapid system updates and upgrades.

- Digital banking systems require high data management capabilities, and data acquisition, analysis and application become the core competitiveness of digital banks. Banks use big data analysis to optimize decision-making, risk management and customer service.

- In terms of user perception, digital banks solve customer acquisition and retention problems and improve user experience through smart channel construction, such as providing services through mobile applications, online customer service and other channels.

- Digital banks emphasize openness. Through open APIs, digital banks are able to share data and services with third-party developers and partners, and there is deep integration between banks and industries to form an open digital bank that provides more industrial cooperation scenarios and digital financial service needs.

- Invisibility of financial services, financial services are embedded in life scenarios, and consumers can access banking services anytime and anywhere.

- Digital banks widely use cloud computing technology to support their flexible business needs and rapid innovation cycles.

- Digital banks make extensive use of AI technologies, such as the use of biometrics such as fingerprints and facial recognition to improve security and convenience, such as the use of big models and machine learning for personalized recommendations, risk assessment, fraud detection and automated customer service.

Technology is the main driver of digital banking, so technological advances and innovations are often decisive for digital banking when financial institutions are conducting digital banking, and banks need to review the use of technology in light of their own resources and business characteristics, and it is critical to choose the right technology implementation strategy when conducting digital banking strategic planning.

As we said earlier, the players in digital banking are not only commercial banks, but also telecom operators, ecommerce companies, Internet enterprises and fintech companies, etc., and their paths of technological realization and evolutionary strategies will be different when they carry out digital banking.

In the process of digitization, the system deployment mode of the core business system of digital banks is an issue that every digital bank cannot avoid, which is related to the independence of business, data, and customer groups, and also needs to consider the regulatory requirements, organizational structure, business development strategy, and capital investment.

System Upgrade Mode

System upgrade mode is to upgrade all or part of the existing core business system to meet the needs of digital banking business. Technically speaking, some conditions need to be met: the technical architecture needs to be upgraded to meet the requirements of digital business, such as the impact of high concurrency and large traffic,

flexible and scalable infrastructure to cope with expansion at any time, higher requirements for network security, rapid product development and iterative capabilities, and the need to have the ability to interface with new technologies to support continuous changes.

The upgrade of business systems can involve the upgrade of individual modules (subsystems) or may require an overall upgrade of the core system.

Partial upgrades necessitate dealing with integration with existing systems, process alignment, interface adaptation, and accounting reconciliation, which often bring additional workload and risks. On the other hand, a comprehensive upgrade implies a significant investment upfront, coupled with the risks associated with overall migration and switching,

as well as regulatory scrutiny, all of which exert pressure on management decisionmaking.

Upgrade mode will also bring hidden costs to the followup, such as the need to adjust the requirements for the existing development and management, operation, including infrastructure, team, etc., and the complexity of the adjustment brings the corresponding operating costs.

There are usually several cases of system upgrade mode:

First, the core system itself has the need to update and modernize. second, the existing system architecture is newer and can be well upgraded in some modules to meet the needs of digital banking business. third, the bank’s internal innovation of digital banking business and the existing business is strongly correlated, and does not require and can not be independent of independent system deployment.

First, the core system itself has the need to update and modernize. second, the existing system architecture is newer and can be well upgraded in some modules to meet the needs of digital banking business. third, the bank’s internal innovation of digital banking business and the existing business is strongly correlated, and does not require and can not be independent of independent system deployment.

System upgrading mode we more often see is the channel type of digital banking upgrades, such as mobile banking (Mobile Banking), mobile wallet (Mobile Money), etc. Banks are bringing banking products and services online through digital upgrades of their channel businesses.

MuRong Technology offers solutions for Mobile Banking, Mobile Money, Mobile Loans, and Digital Payments, providing banks with flexible digital banking upgrade plans.

Independent System Deployment Mode

The independent system deployment model in the banking sector is also referred to as the “dualcore” model or the “greenfield” approach (as termed by McKinsey). In simple terms, this means that the existing core business system supports traditional banking operations, while a newly deployed core business system supports digital banking services.

This model offers several advantages: First, the technical implementation is relatively straightforward, with clear integration with existing systems, and independence in data, operations, and development, which allows for risk isolation. Second, the adoption of new technological architectures easily meets digital requirements with minimal implementation risks.

Third, it supports new technologies and maintains continuous iterative delivery, which is beneficial for supporting continuous business innovation. Fourth, it enables the rapid launch of digital banking services.

However, the standalone model requires further investment in subsequent ecological integration with existing traditional banking services.

Choosing an independent deployment is generally for businesses that operate autonomously, such as standalone digital banking divisions within banks, telecommunications operators, fintech companies, and microfinance banks.

Additionally, the independent deployment model typically requires an end-to-end comprehensive solution, which means providing a complete package from channels (mobile) to products to accounting.

MuRong Technology’s Digital Banking product provides an end-to-end complete digital banking solution, supporting banks to independently and quickly carry out digital banking business.

Typical Cases

1. NCBA

NCBA Bank, the third largest bank in Kenya, is at the forefront of African banks in terms of digital transformation, with notable growth in the area of digital lending in particular. NCBA offers a large number of digital loans through platforms such as M-Shwari and Fuliza.

In 2020, MuRong Technology provided NCBA with the next generation digital banking core business system with an end-to-end digital banking core business solution for digital loans, digital payments, digital deposits and Super App. After the system fully go lived, it provides excellent support to NCBA's digital banking business:

1. Improved transaction processing capacity, TPS (Transaction Per Second) increased by 5 times, greatly improving the level of user experience.

2. It reduces operational costs and improves operational efficiency through fully automated processes.

3. The new system supports agile development, which greatly accelerates the development of new products and greatly reduces TTM (Time-to-Market) time.

4. The new system architecture significantly reduces overall IT infrastructure costs.

NCBA Bank’s digital banking business has not only been a success within Kenya, but has also played an important role in driving financial inclusion across the African region. Through continuous technological innovation and partnerships, NCBA is becoming a leader in digital financial services in Africa.

2. China Telecom

China Telecom Corporation Limited is one of the three major telecommunications operators in China, with approximately 300 million users. Leveraging its vast customer base, China Telecom has embarked on digital finance services,

conducting e-commerce, payment, and other digital finance businesses through consumer, settlement, and industrial data scenarios.

MuRong has provided China Telecom with digital banking products such as Digital Payment, Micro Finance, Mobile Money, and Super App. These support the evolution and expansion of China Telecom’s services from a single payment function to a comprehensive financial service that includes membership wallets and consumer credit.

Cutting-edge technologies like cloud computing, big data, and artificial intelligence are utilized to provide robust support for subsequent business innovations:

1. Convenient Lifestyle Services:

Including online businesses such as e-commerce, public services, and benefits services, covering all aspects of daily life, allowing users to enjoy the convenience and excellent user experience brought by digital services anytime, anywhere.

Including online businesses such as e-commerce, public services, and benefits services, covering all aspects of daily life, allowing users to enjoy the convenience and excellent user experience brought by digital services anytime, anywhere.

2. Digital Financial Services:

The business includes wealth management, insurance protection, consumer finance, and personal loans. The application of digital technology makes inclusive financial services accessible to everyone.

The business includes wealth management, insurance protection, consumer finance, and personal loans. The application of digital technology makes inclusive financial services accessible to everyone.

3. Merchant Services:

Including aggregated payment collection and merchant gold cards, enabling smarter operations, a more open ecosystem, and empowering new commercial operation models.

Including aggregated payment collection and merchant gold cards, enabling smarter operations, a more open ecosystem, and empowering new commercial operation models.

China Telecom Corporation Limited is one of the three major telecommunications operators in China, with approximately 300 million users. Leveraging its vast customer base, China Telecom has embarked on digital finance services,

conducting e-commerce, payment, and other digital finance businesses through consumer, settlement, and industrial data scenarios.

MuRong has provided China Telecom with digital banking products such as Digital Payment, Micro Finance, Mobile Money, and Super App. These support the evolution and expansion of China Telecom’s services from a single payment function to a comprehensive financial service that includes membership wallets and consumer credit.

Cutting-edge technologies like cloud computing, big data, and artificial intelligence are utilized to provide robust support for subsequent business innovations:

China Telecom’s digital banking business has developed rapidly, with monthly active users exceeding 50 million and annual transaction volumes nearing 2 trillion. It has connected with tens of millions of offline merchants such as China Resources, Yonghui, Walmart, Mannings, and Suning,

as well as hundreds of online e-commerce platforms like Suning.com, JD.com, Tmall, Ele.me, NetEase Youxuan, and Meituan. The consumer finance installment business has developed more than 20 million customers.

3. Kenya Commercial Bank

Kenya Commercial Bank (KCB) is the largest bank in East Africa, operating in seven countries with 38 million customers, 566 branches, and an asset size exceeding 2 trillion Kenyan shillings.

MuRong Technology has provided KCB Bank with a new generation of mobile banking systems, covering channels such as mobile banking, WEB, and USSD, and encompassing all retail and SME business services.

The mobile banking system of KCB Bank is a significant step in the bank's digital transformation. It refines customer group operations and differentiates user experiences at the user level. At the channel level, it achieves coordinated operation across all channels and closed-loop processing of the entire marketing process. At the scenario level, it engages in scenario-based customer acquisition and ecosystem construction.

At the product level, it includes traditional banking services such as deposits, loans, and remittances, as well as new types of mobile online loans, insurance, and investments. Through a multi-dimensional and comprehensive upgrade of mobile banking, it supports KCB Bank’s digital transformation.

4. China Construction Bank

China Construction Bank (CCB) is the second-largest commercial bank in China, with its digital banking business deeply integrated into its vast business system. In 2018, CCB initiated a digital banking platform as an innovative pilot in Guangdong, beginning to provide digital financial services for online transaction scenarios.

Currently, the platform has a broad coverage, supporting dozens of industry ecosystems including standard e-commerce, exchanges, new retail, car sales, airports, and government taxes. It serves hundreds of large clients, supports hundreds of thousands of terminal merchants, and has an annual transaction volume exceeding hundreds of billions of RMB.

MuRong Technology has provided China Construction Bank with a digital banking system and exceptional Center of Excellence (COE) services. The system is based on the concept of "online transaction fund management", integrating functions such as account management, fund custody, payment, clearing and settlement, reconciliation, authentication and identity recognition, and anti-money laundering monitoring. It has created a full-process embedded digital banking service platform that matches the flexible demands of internet business forms and boasts features such as high security, high reliability, and low operational costs.

China Construction Bank will face future challenges through product innovation, enhancing customer experience, and data-driven decision-making. This ensures its competitiveness in the evolving financial ecosystem, meeting the growing needs of its customers, and maintaining a leading position in the fiercely competitive market.