At the same time, fintech also creates new opportunities for traditional commercial banks. The rapid digital transformation can take the lead in the digital financial field. By leveraging digital products and innovative services, bank can effectively improve customer experience, reduce operating costs, and increase profitability and competitiveness.

Of course, such criticism also comes from the sense of urgency to quickly launch digital banking and seize the market. After a series of competitions and selections, MuRong became the most ideal partner at last. MuRong's victory was due to the overwhelming advantage of its digital banking products and solutions, which fully meet CCB needs.

-

Technical AdvantagesUtilizes microservices, containers, and Kubernetes for seamless deployment, scalability, and resilience, enabling agile operations with continuous integration and delivery.A mini-app framework and APIs enable seamless integration and the building of a financial ecosystem.The integration of multiple digital channels, provides customers with a unified and consistent experience across all touchpoints.Automated reconciliation, error processing, reporting, risk control, chatbot, and monitoring with automated alerts.The system has multi-dimensional security protection capabilities to ensure system security.

-

Product AdvantagesComprehensive digital banking service, Includes account management, instant and scheduled transfers, personalized financial planning tools, overdrafts, digital payments, loans, and buy-now-pay-later options, catering to the needs of both individual customers and micro, small, and medium enterprises (MSMEs).Transaction processing that meet the various industries, such as e-commerce, exchanges, transportation, education, consumer finance, and online lending.A range of marketing tools, such as discounts, coupons, and rewards, combined with online and offline campaigns, cultivates a strong sense of connection and loyalty to your brand.The product has intelligent risk control and meets regulatory requirements such as anti-money laundering, anti-fraud, blacklist.

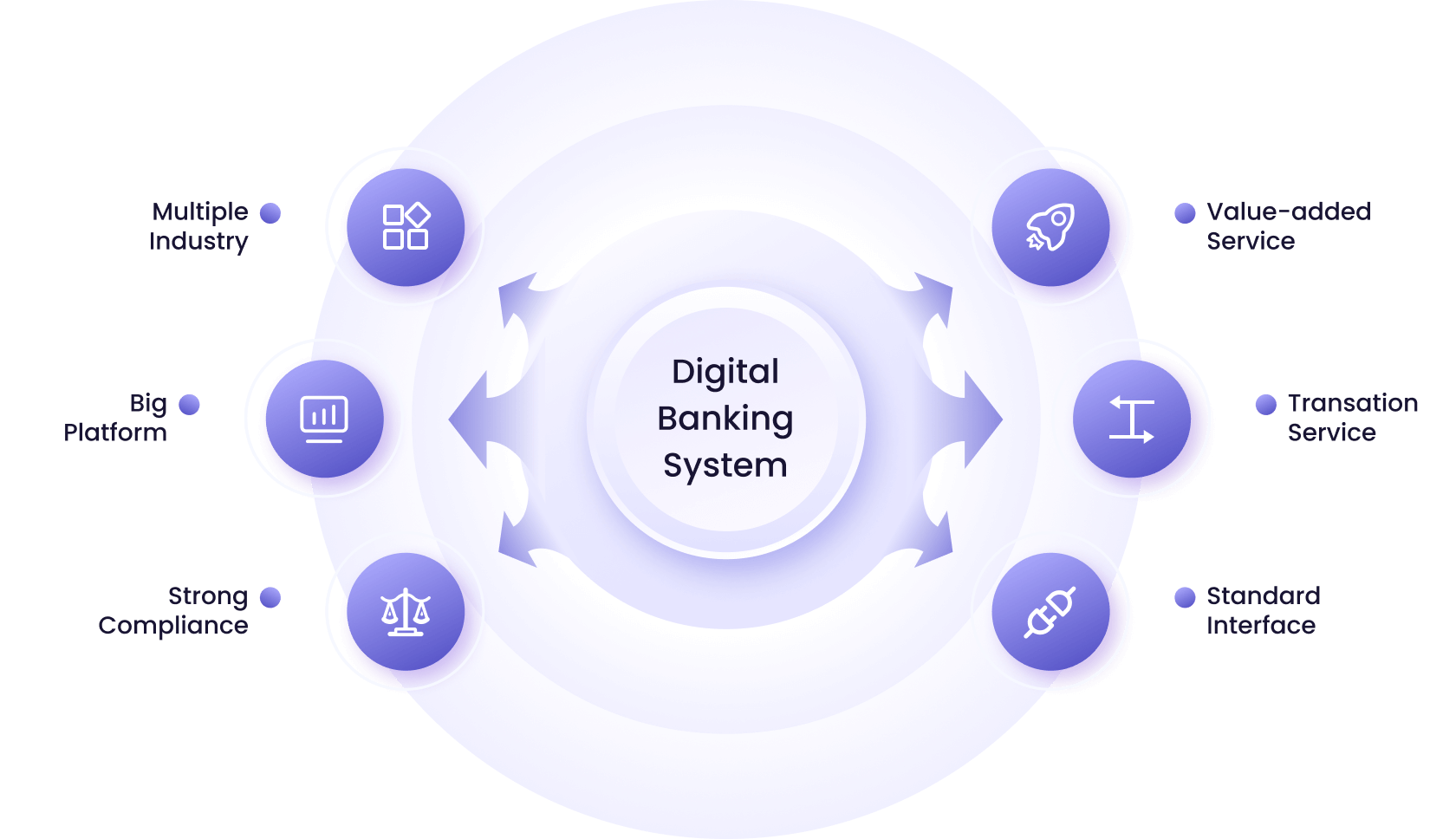

- A complete set of digital banking products and solutions

- Innovation in online business processes

- Standardization of API Management

- Standardization of financial services by industries

- Embedded financial components for different industry

- BStandard process of integration

Utilizing the architectural advantages of MuRong products, the complex monolithic large system of CCB is decoupled into a micro-service distributed architecture. In this way, the system's scalability is comprehensively enhanced and the operation capabilities of CCB can be expanded at any time to meet the growing business needs. The architecture design ensures the high availability and reliability of the core system, making it easier to win customer trust.

‘Green Field Model’, choosing an end-to-end digital banking solution, Smooth transition, rapid deployment and upgrade, seamless integration with existing core business systems and other third-party systems without disruption to business operations achieve low-cost, high-efficiency, and 0-risk digital transformation.

MuRong products provide comprehensive digital banking services, integrate with multiple digital channels, build unified APIs, and completes the construction of a digital financial ecosystem.

CCB improves digital marketing skills through automation and artificial intelligence, and achieves digital operation through the use of digital and analytical tools which bring operational industrialization and rapid growth in performance.

Through the intelligent integration of financial business scenarios, CCB enhances data processing and modeling capabilities, and builds an automated, real-time, and intelligent risk control management system, which significantly enhances risk control and management capabilities.